Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

07/18/2018, Paris

Arthur Sadoun, Chairman and CEO of Publicis Groupe:

“First half of 2018 was a busy but very productive period for Publicis Groupe. We have focused on 3 main objectives directly in line with our 3-year transformation plan, Sprint To The Future.

First, we have set the financial conditions to deliver our full year 2018 targets of organic growth and margin expansion. First half organic growth was slightly negative as in 2017, but with an improvement in North America which turned positive. This is an encouraging sign as this is where our new model is the most advanced. We saw a slowdown from our good first quarter of +1.6% to a second quarter at -2.1%, mostly due to two conjunctural challenges – tougher basis of comparison and uncertainty relating to GDPR implementation impacting our net revenue in Europe – but also to one specific operational bump with our volatile health sales representatives business in the US. This bump represents the biggest share of our negative growth as the overall impact of our Publicis Health business was around 30 million euro.

Despite the environment, we showed a 60 basis point margin improvement and 40 basis points on a comparable basis at constant restructuring charges. This 40 basis point expansion actually includes +70 basis points thanks to cost savings and investment in our game changers representing 30 basis points. These reflect two important points: first, we are making progress in delivering on our efficiency plan, demonstrating our ability to reduce costs while providing more high value products and services to our clients. Second, we are investing in our key strategic capabilities to build the growth of the future.

Overall, our first half financial results, combined with our impressive new business wins that will start ramping up in the second half, make us confident to deliver our full year objective of improving growth and margin versus 2017.

Our second objective was to accelerate our transformation by scaling up our new model connecting data, creativity and technology to accelerate our organic growth.

During this semester, we continued to develop our global practices and simplify our structure in the countries where we operate and the way we work with our clients. We are on track and sometimes ahead on all the KPIs we communicated during the Investor Day in March 2018.

We are actually experiencing very high growth, above 25%, in what will be the core of our offer in the future: our strategic game changers, namely data, dynamic creativity and digital business transformation.

Being at the core of our client transformation has made us win like never before with our existing clients and in new business, be it globally with Daimler, Campbell's and Marriott, or locally with McDonald’s, Macy’s and Nestlé. The momentum is continuing in Q3, and only last week, we announced the wins of Lenovo media globally, P&G Shopper in the UK and Nestlé in the US.

I reiterate, if necessary, that our market has been facing major challenges and transformation has become a necessity for all. Initiatives we launched very early and acquisitions we made are bearing fruits: we are able to overcome unavoidable budget cuts and changes in marketing plans thanks to our assets and our organization that position us in the most competitive way possible.

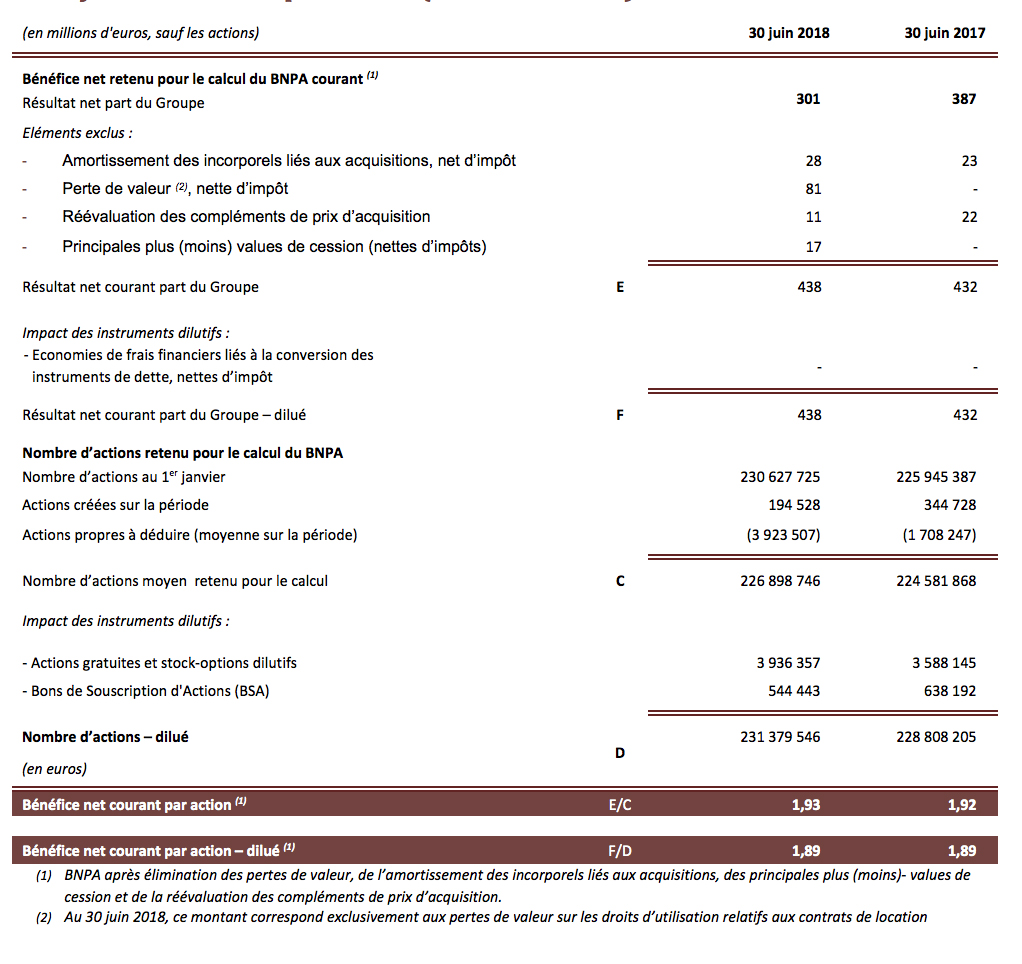

Our third objective was to increase shareholder value to make sure we reward our shareholders for the trust they put in our transformation journey. During this semester, we were able to deliver strong financial results, beyond organic growth. We improved margin significantly, headline EPS went up 13% at constant currency, and our financial situation is stronger with a net debt reduction of almost 1 billion euros over the last 12 months.

No doubt, during H1, we have set the foundations to deliver our full year objectives and even more importantly our 3 years transformation plan. It will not be an easy journey as we must transform ourselves while facing some strong market headwinds. There could be some unexpected bumps in the road like the one we just experienced in the health sector. But we have an outstanding team, unmatched capabilities in data, creativity and technology and a proven winning model that make us very confident for the future.”

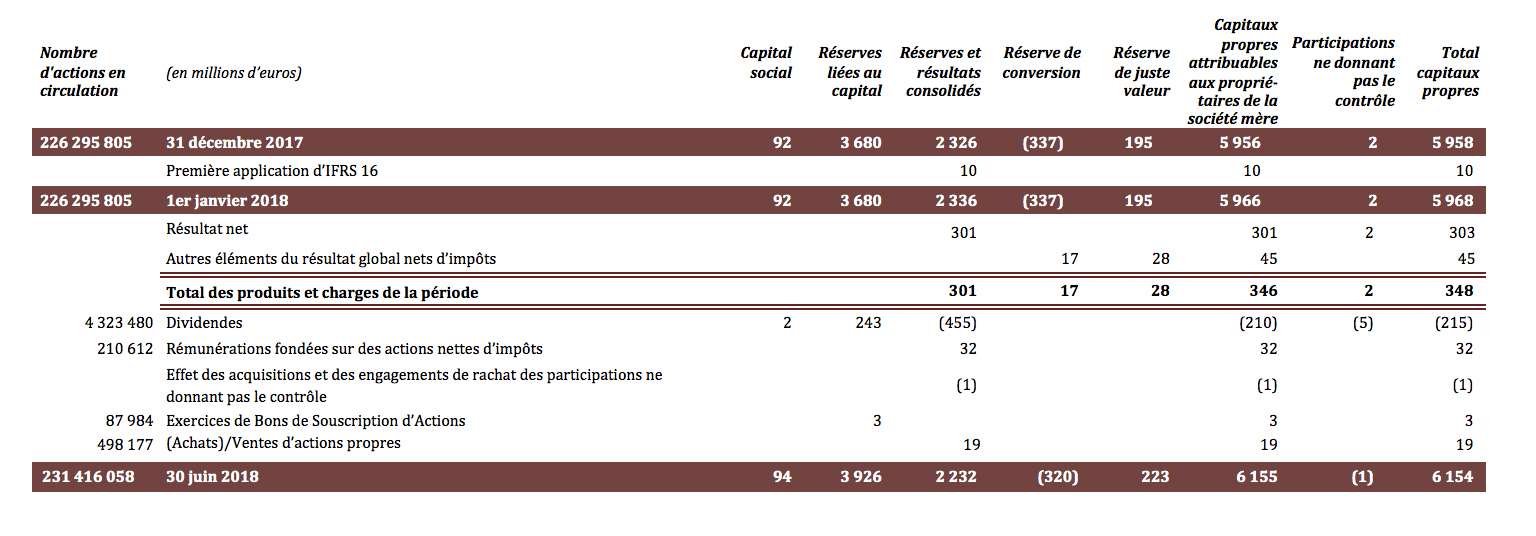

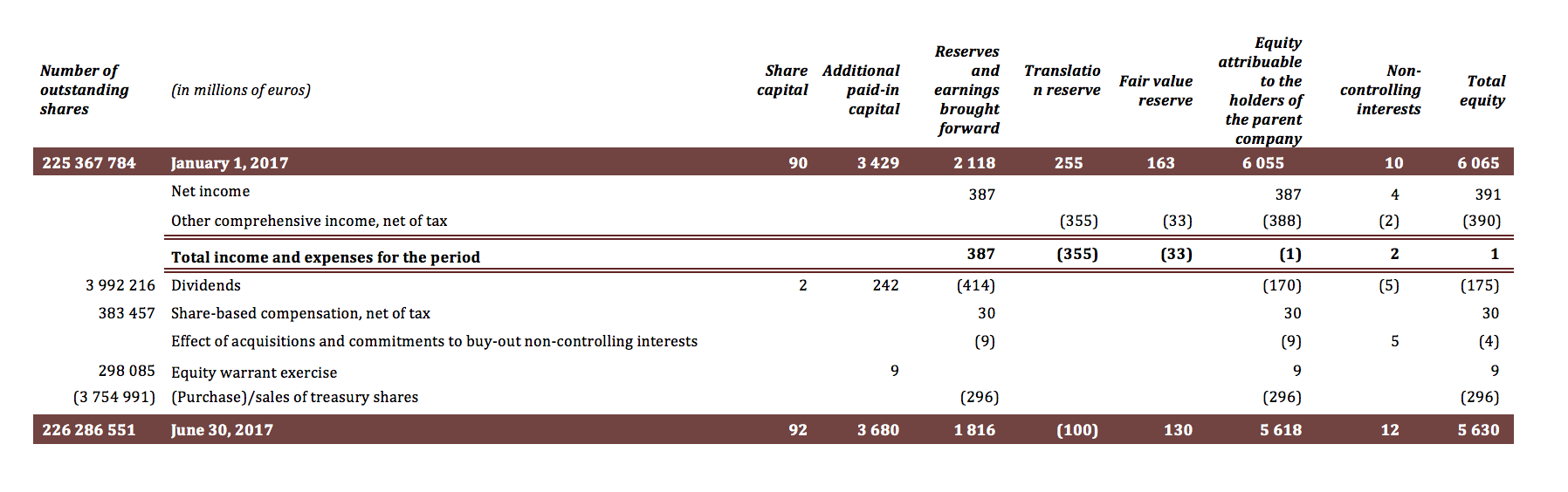

Publicis Groupe’s Supervisory Board met on July 18, 2018, under the chairmanship of Maurice Lévy, to examine the accounts for the first half of 2018 presented by Arthur Sadoun, CEO and Chairman of the Management Board.

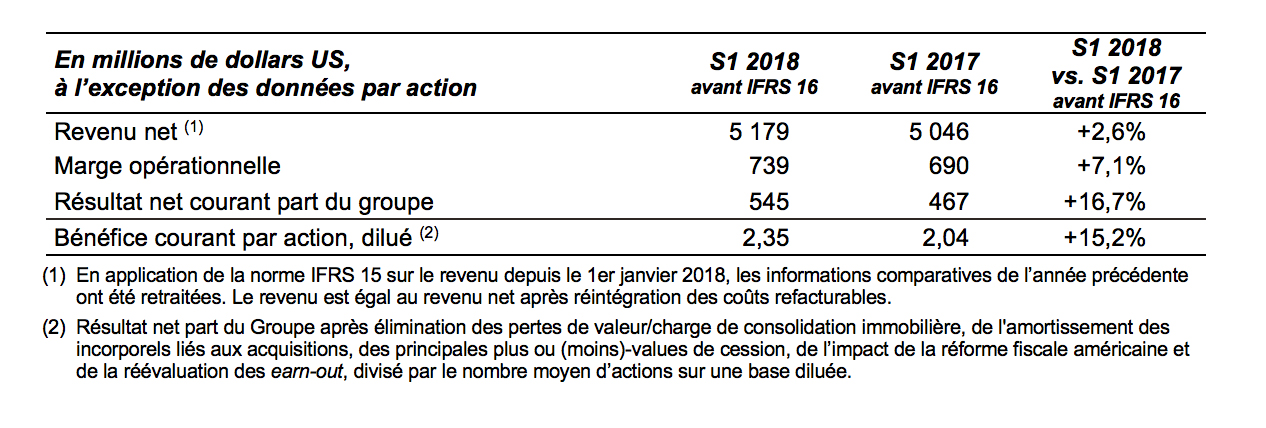

Nota bene: All comparisons of H1 2018 numbers with H1 2017 numbers are done before impact of

IFRS 16 accounting standard.

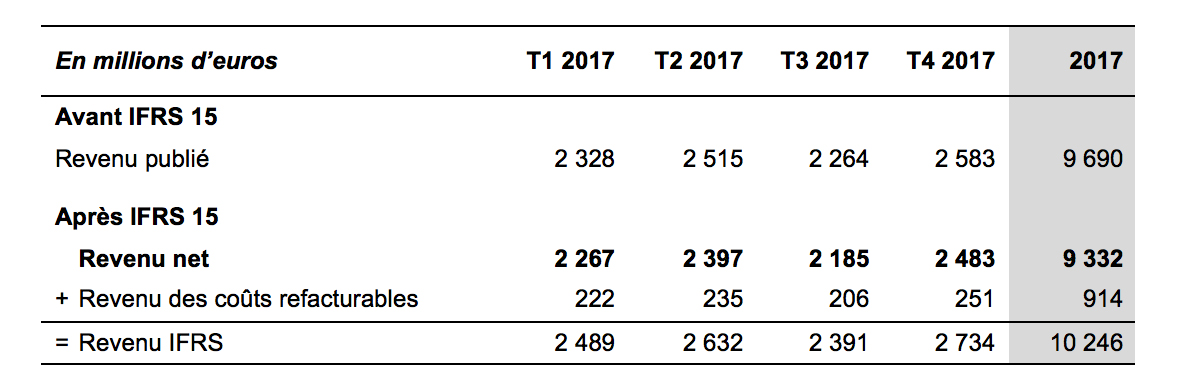

Publicis Groupe has applied IFRS 15, the accounting standard on revenue recognition, since it became effective on January 1, 2018. The 2017 financial statements have therefore been restated for the purposes of comparison with revenue since the standard came into force. This accounting standard increases IFRS revenue insofar as certain costs re-billed directly to clients are excluded from revenue. These costs mainly concern production activities as well as various expenses incumbent on clients.

In this context, as the items that can be re-billed to clients do not come within the scope of assessment of operations, Publicis Groupe has decided to use a different indicator, i.e. net revenue , which is a more relevant indicator to measure the operational performance of the Groupe’s activities.

The table below provides a detailed account of revenue reported for 2017 before the impact of IFRS 15, as well as the 2017 figures restated after applying IFRS 15, i.e. net revenue and revenue.

Details of 2017 net revenue by quarter and by geography, and the main items of 2017 half year and full year results before and after IFRS 15 impact, have been disclosed in a press release dated July 6, 2018 (available on our website: www.publicisgroupe.com).

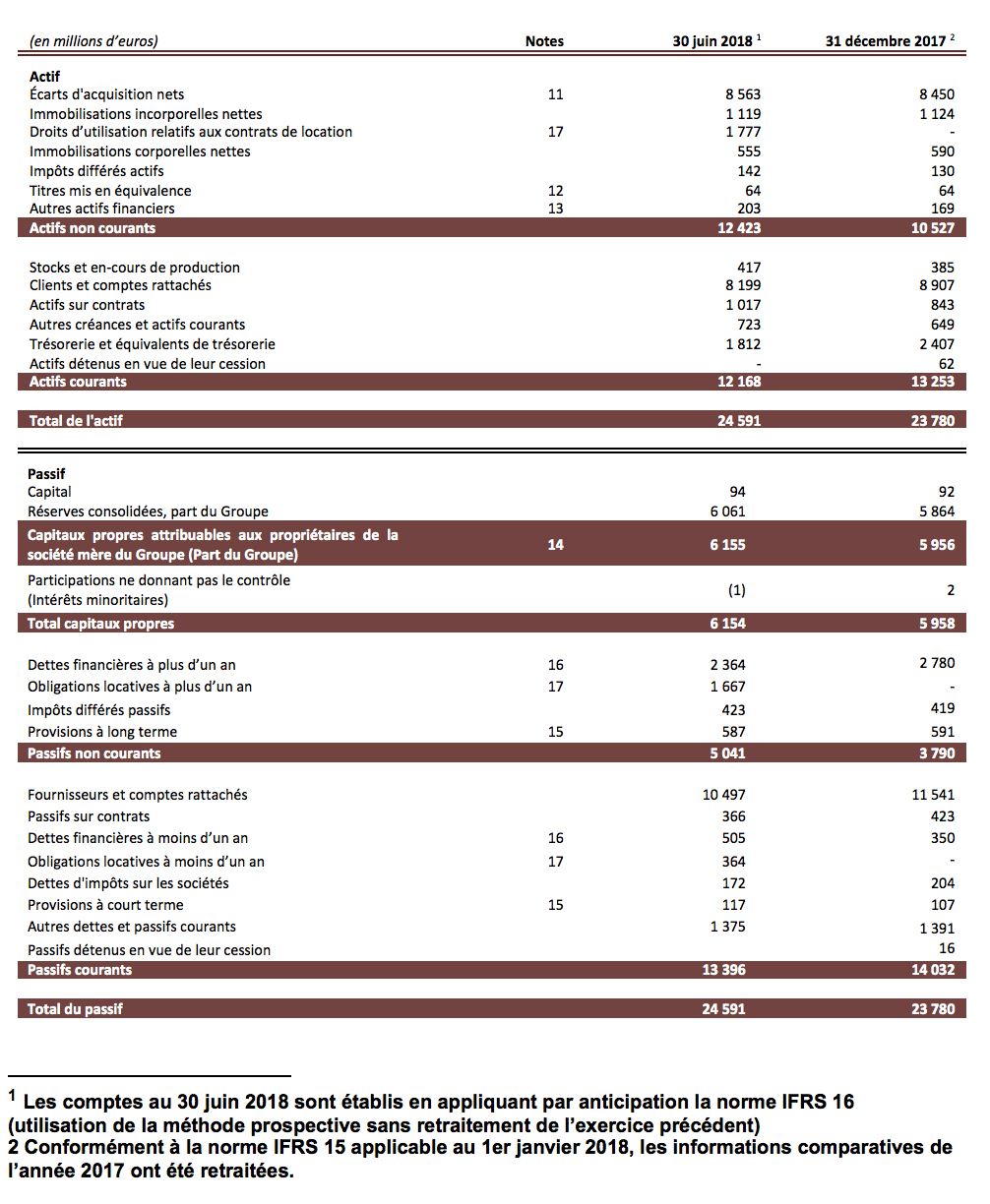

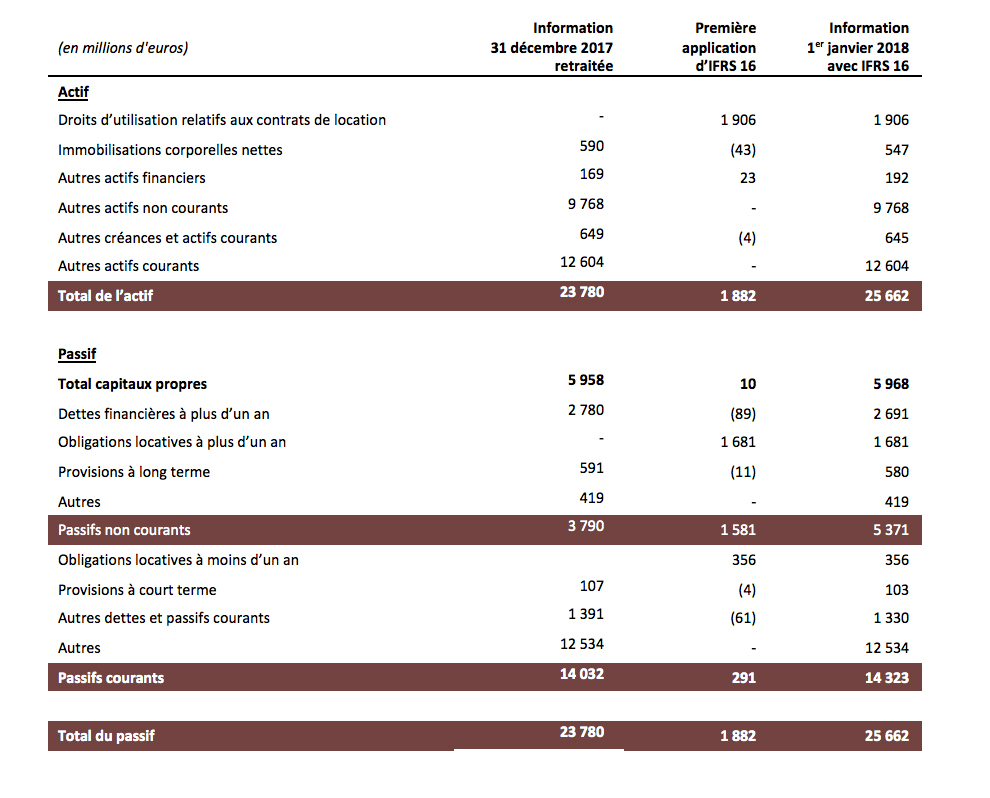

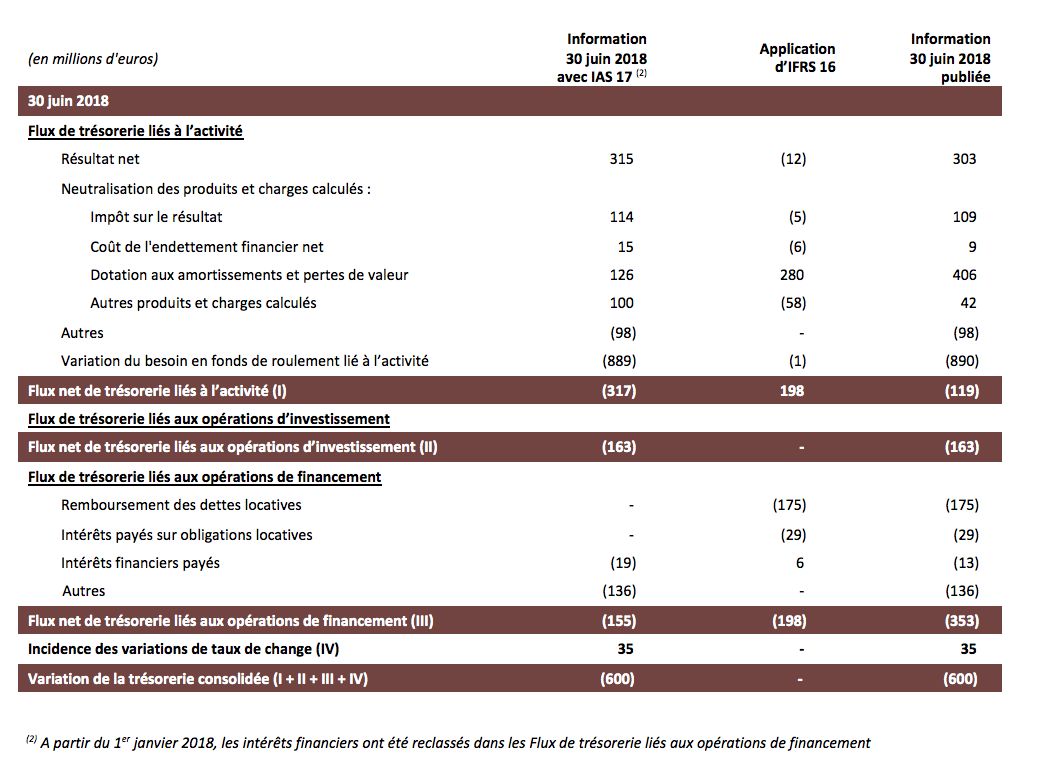

Publicis has decided to early adopt IFRS 16 accounting standard as of January 1, 2018.

This accounting standard considers all lease contracts under a single model by which a lease contract is accounted for as a liability (discounted future payments), and a right of use is accounting for as an asset. The right of use will be amortized over the period of the lease contract (taking into account option periods during which the exercise is reasonably certain).

Contracts committed by Publicis for which this accounting standard applies, are:

Publicis has retained the “prospective method” allowed by the accounting standard by which the cumulative effect of the standard will be accounted for as an adjustment to the opening equity, considering the “right of use” asset equals the amount of the lease commitment, adjusted for rents paid in advance. The opening balance sheet at January 1, 2018, after application of IFRS 16, is presented in the press release dated July 6, 2018 (available on our website: www.publicisgroupe.com). Furthermore, the 2017 consolidated income statement will not be restated. The Groupe will communicate 2018 half-year and full-year results including IFRS 16 and will provide those financial items excluding IFRS 16.

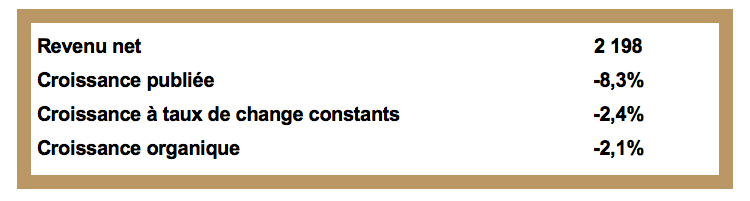

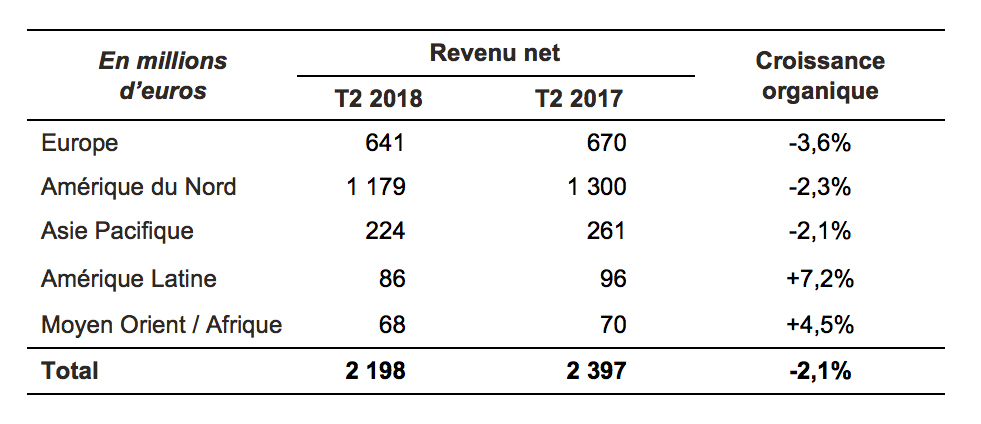

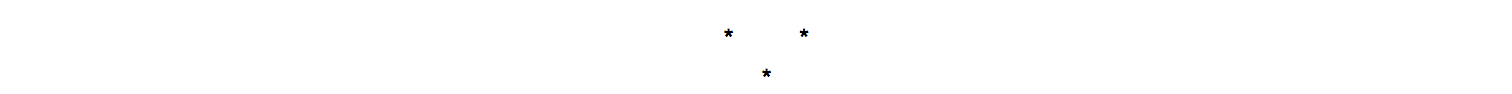

Publicis Groupe’s net revenue in Q2 2018 was 2,198 million euro, i.e. an 8.3% decline from 2,397 million euro in 2017. At constant exchange rates, growth was -2.4% after a 145 million euro negative impact of currency (-6.0% impact). Net acquisitions contributed a negative 5 million euro to net revenue in Q2 2018 following the deconsolidation of Genedigi from January 1, 2018.

Organic growth was -2.1% in Q2 2018. This is a slowdown by comparison with the +1.6% recorded in Q1 2018 due to the strong comparable period in 2017, especially in North America. The Groupe has yet to register the benefits of the accounts won in the first quarter, which will only contribute to organic growth from Q3 2018 onwards. Furthermore, organic growth was affected by implementation of GDPR (General Data Protection Regulation) in Europe which caused several campaigns to be temporarily suspended at the initiative of clients but also at the initiative of Publicis due to uncertainties surrounding the obtaining of consumer consent via the websites on which these campaigns are rolled out. Mention should also be made of the difficulties encountered in the healthcare sector, notably concerning the activities of Contract Sales Organizations (see paragraph below).

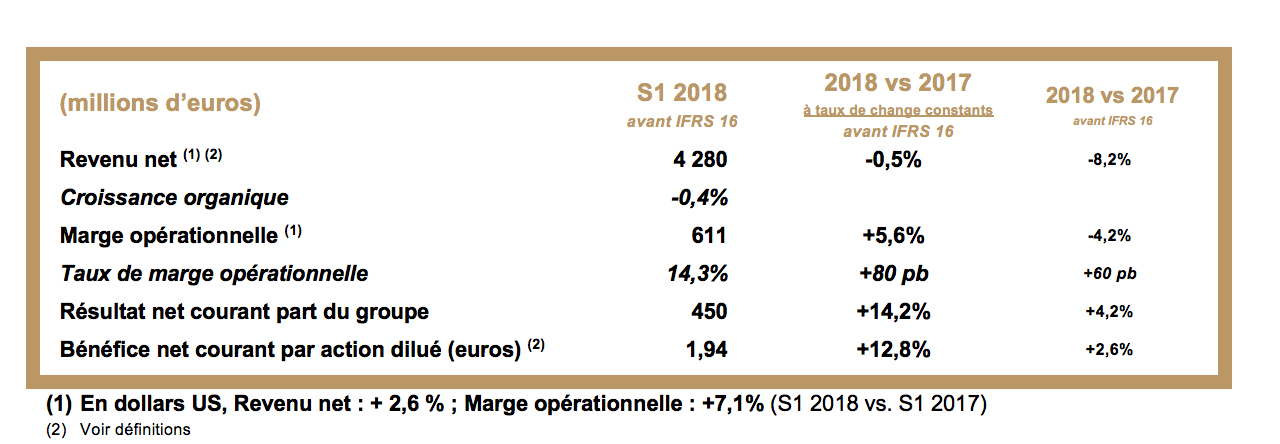

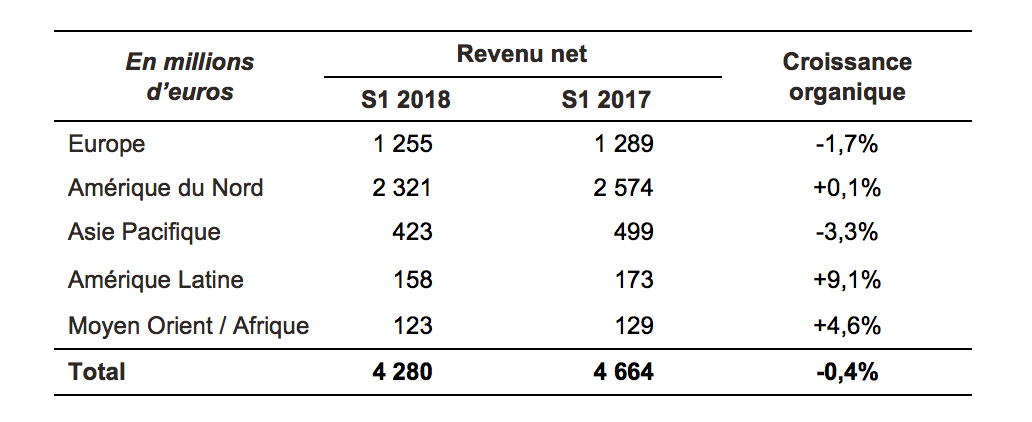

Publicis Groupe’s net revenue in H1 2018 was 4,280 million euro, down 8.2% from 4,664 million euro in H1 2017. At constant exchange rates, growth was -0.5%, after exchange rates adversely affected net revenue by 362 million euro (-7.8% impact). Net acquisitions contributed a negative 6 million euro to net revenue in H1 2018 following the deconsolidation of Genedigi from January 1, 2018. Organic growth was -0.4% in H1 2018

In US dollars, Publicis Groupe net revenue was up 2.6%.

The healthcare sector is undergoing radical transformation everywhere in the world. At a time when medical research and sales have moved on from the blockbuster era to an era of more specialized therapies, it has become necessary to adapt the marketing and propose measures that target patients and prescribers much more specifically. Publicis Health, Publicis Groupe’s solution hub in healthcare, has developed an offering aligned with these needs – which revolves around data, dynamic creativity and digital business transformation.

Beyond creative and media activities, Publicis Health has a very distinctive positioning in the healthcare communications sector with Publicis Health Solutions (PHS). This entity supplies CSOs (Contract Sales Organizations), a line of business that does not exist in other healthcare communications networks and where our competitors are mostly specialized in outsourcing. By its very nature, this business is highly volatile and developments in the healthcare sector have led clients to make last-minute adjustments, leading to the postponement or even the cancellation of campaigns.

Publicis Health saw its revenue decline in the first half year, particularly that of PHS, its outsourcing business. Publicis Health remains committed to providing its clients with the best and this will require investing in health-related consulting, data and technology, in order to continue providing our clients with cutting-edge expertise for their digital transformation. The Groupe will continue to look at every opportunity to create as much value as possible from all its operations, for the greater benefit of all stakeholders.

Europe posted negative growth of -2.6%. With acquisitions and exchange rates factored out, organic growth stood at -1.7%. In addition to the loss of a few accounts, this weak growth should be seen in the perspective of a difficult comparable period as growth in H1 2017 was +4.3%. Furthermore, there were the induced effects of the GDPR (General Data Protection Regulation) in Europe which caused several campaigns to be temporarily suspended, at the initiative of clients but also at the initiative of Publicis, due to uncertainties about obtaining consumer consent via the websites on which these campaigns are rolled out. Given this general context, the main countries are down in Q2 year-on-year (France, Spain and Switzerland). Among the main markets mention should be made of the good performance of the UK (+1.7% in H1, +2.2% in Q2) and the sharp decline in Germany (-8.3%) where the comparable period in 2017 saw particularly strong growth.

North America achieved organic growth of +0.1% in H1 2018, shored up by accounts won in 2017 (including McDonald’s, Diesel, Lionsgate, Molson Coors and Southwest). The region is affected by the difficulties encountered by Publicis Health whose net revenue declined by some 30 million euro over the first six months of 2018. Given the impact of exchange rates, North America’s revenue fell by 9.8% compared with 2017.

Asia Pacific saw its net revenue decline by 15.2 % and its organic growth drop 3.3% over the period. This negative performance is largely attributable to Australia (-10.8%) which has been impacted by the discontinuation of the Qantas call center contract. China posted satisfactory growth, returning to positive territory (+0.4%) despite the impact of accounts lost. Singapore saw its net revenue rise by +6.3%.

Latin America reported net revenue down 8.7% but organic growth of +9.1%. In Brazil, net revenue progressed by 7.6% thanks to the gain of the Petrobras and Bradesco accounts. Mexico continued to record sustained growth at +9.7%.

The Middle East & Africa reported a decline of 4.7% but organic growth of +4.6% driven by South Africa (+11.1%) and the United Arab Emirates (+6.2%).

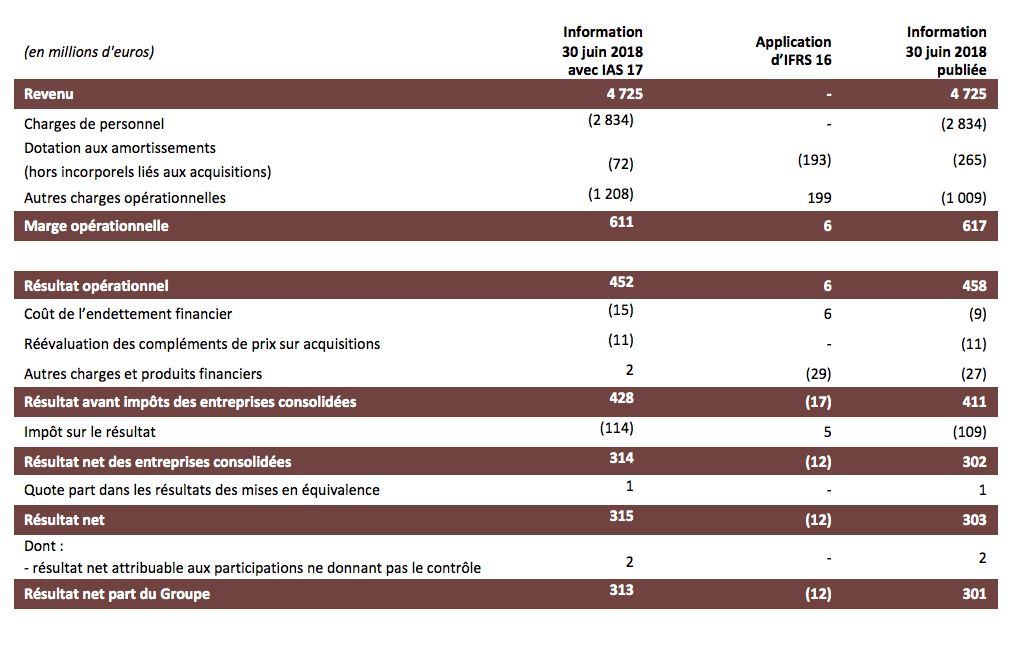

Unless otherwise stated, figures are presented before impact of IFRS 16.

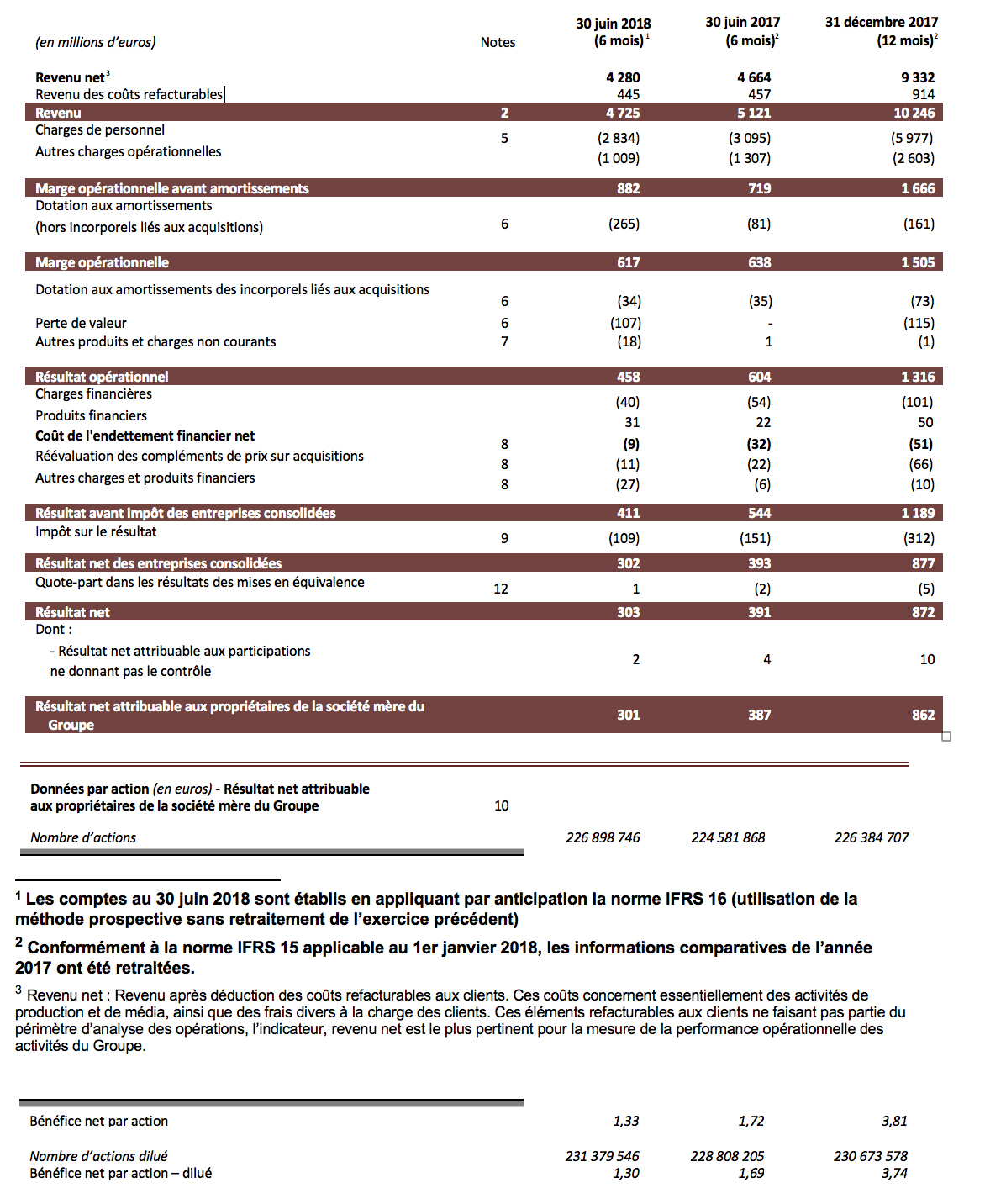

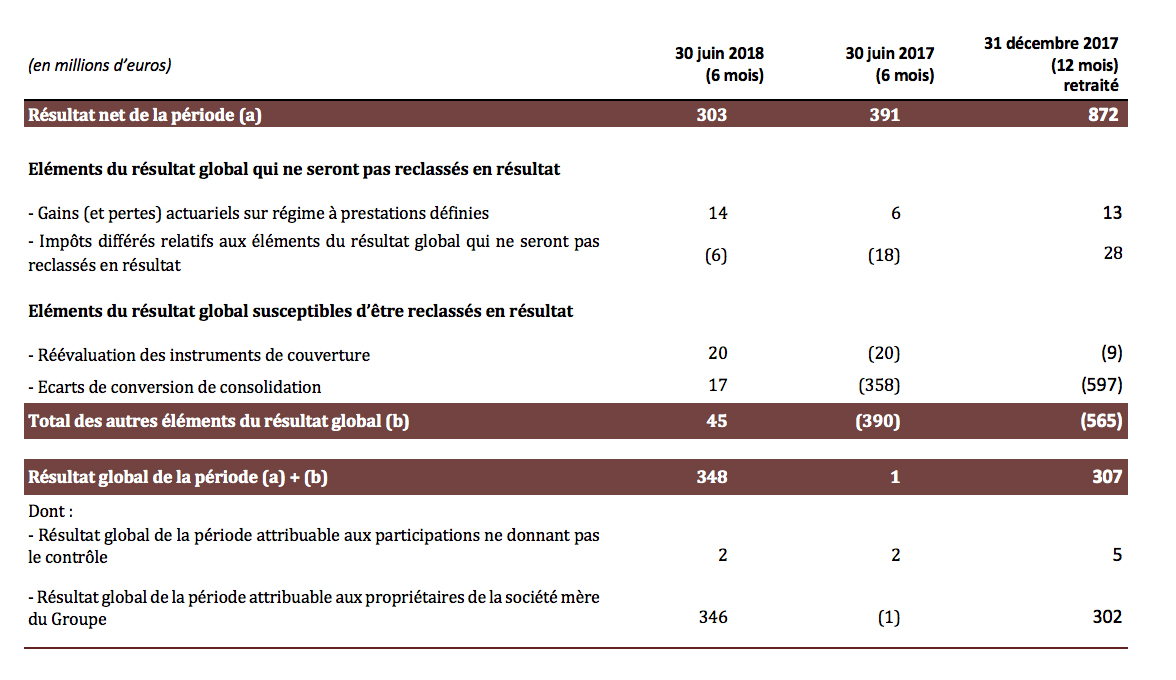

Income statement

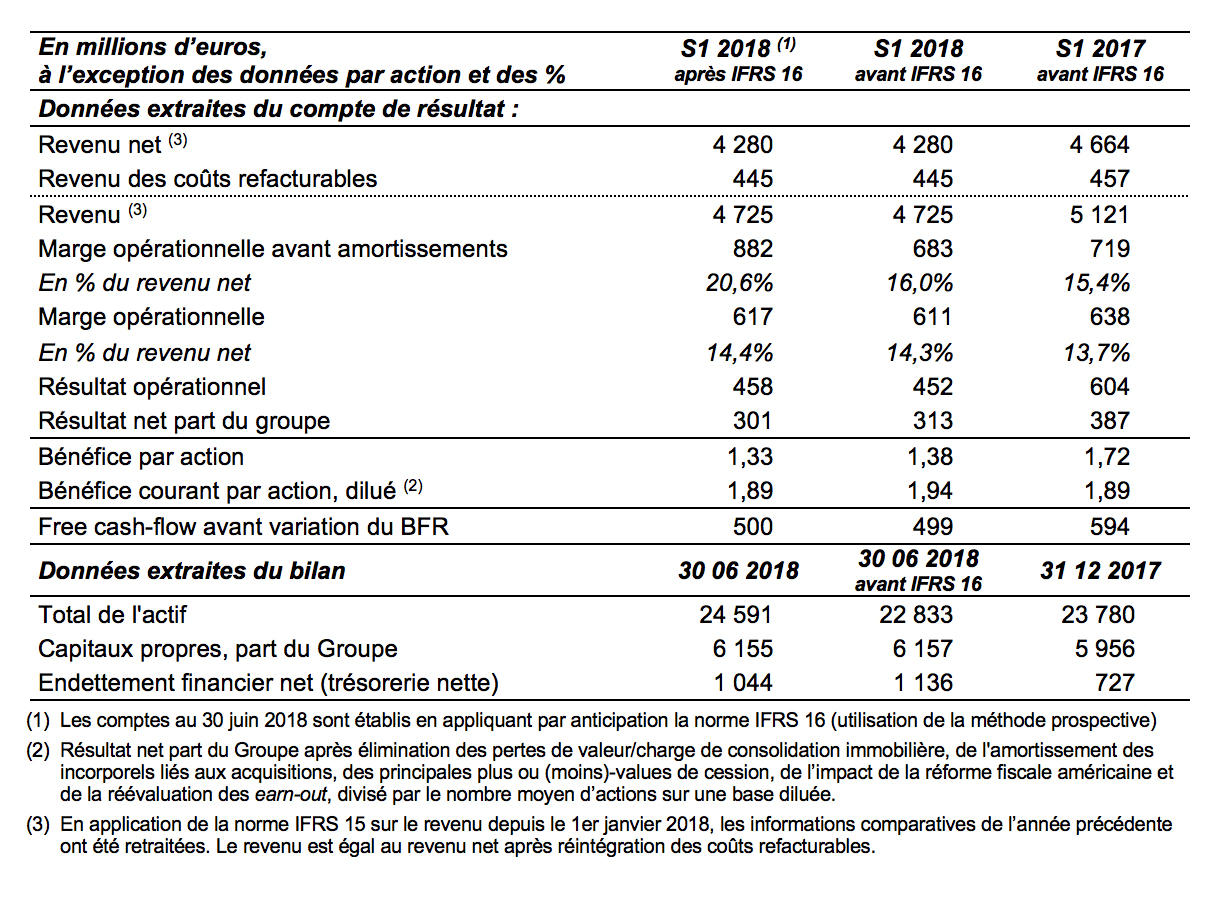

The operating margin before depreciation & amortization was 683 million euro in H1 2018, down 5.0% from 719 million euro in 2017, i.e. a percentage margin of 16.0% of net revenue (vs. 15.4% in 2017):

Depreciation & Amortization for the period amounted to 72 million euro in 2018, down 11.1% by comparison with H1 2017.

The Operating margin was 611 million euro, i.e. a 4.2% decrease from 638 million euro in 2017. At constant exchange rates, the Operating margin rose by 5.6%. Operating margin rate was 14.3%, up 60 basis points over 2017. On a like-for-like basis (constant exchange rates and constant scope of consolidation), it was 70 basis points higher than in 2017. This improvement was due to the downswing in restructuring costs (for 30 basis points), and to the impact of the cost savings program over the last 18 months (for 70 basis points), despite the investments made to accompany growth of game changers (for -30 basis points) .

By region, the operating margin was 12.2% in Europe, 17.3% in North America, 9.7% in Asia Pacific, 8.2% in Latin America and 1.6% in the Middle East & Africa.

Amortization of intangibles arising on acquisitions totaled 34 million euro in H1 2018, versus 35 million euro in 2017. Impairment - Real estate consolidation totaled 107 million euro that was mainly due to real estate restructuring costs incurred by our real estate program “All in One” commenced in early 2018. In addition, non-current income and expense was a charge of 18 million euro (compared with 1 million euro in H1 2017) which corresponds to 17 million euro of capital loss for Genedigi before the sale of this entity was completed at the start of April 2018.

Operating income totaled 452 million euro in H1 2018, after 604 million euro in H1 2017.

Financial income (expense), comprised of the cost of net debt and Other financial income and expenses, amounted to an expense of 13 million euro in H1 2018, down from an expense of 38 million euro for the corresponding period in 2017. The cost of net debt was 15 million euro in H1 2018, after 32 million euro in 2017. Other financial income and expenses netted out at income of 2 million euro after an expense of 6 million euro in H1 2017.

The revaluation of earn-out payments amounted to an expense of 11 million euro in H1 2018, down from an expense of 22 million in 2017.

Income tax for the period was 114 million euro, stemming from the application of a forecast effective tax rate of 25.9% for 2018, after 151 million euro in H1 2017, corresponding to a forecast effective tax rate of 26.7%.

The Associates share of profit was 1 million euro, compared with a loss of 2 million in H1 2017. Minority interests totaled 2 million euro in H1 2018 after 4 million in 2017.

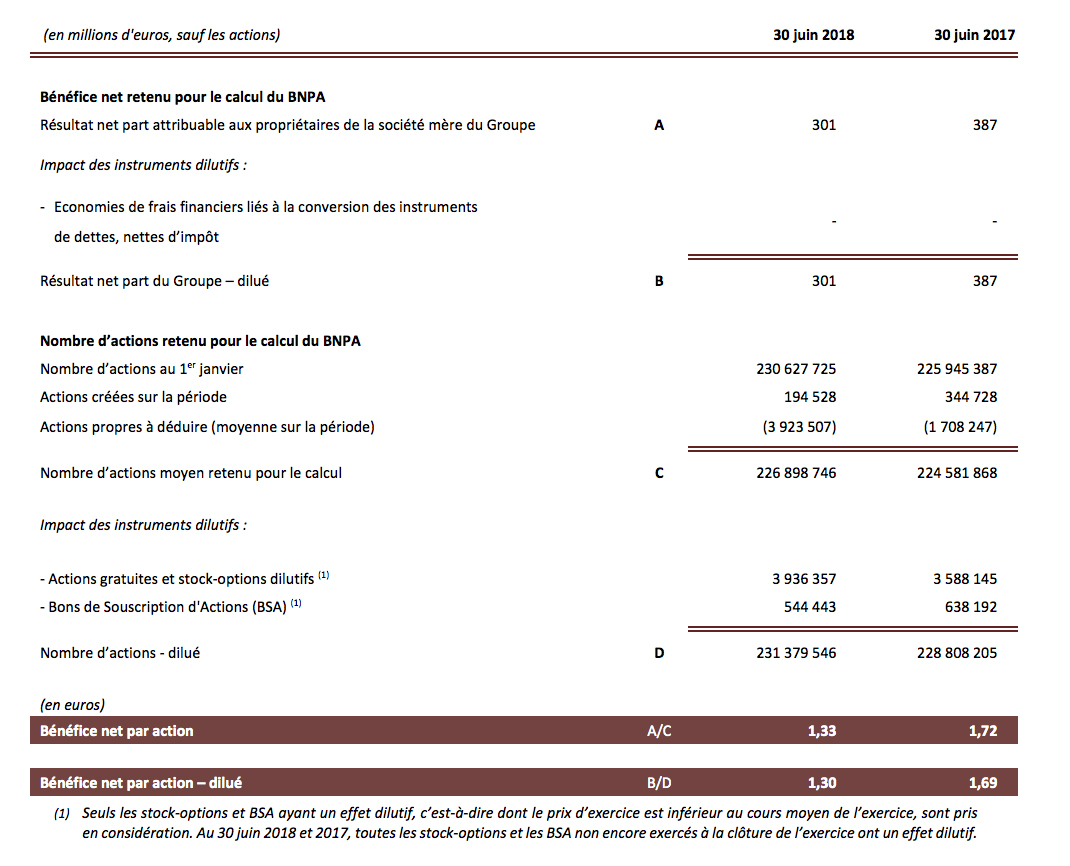

Overall, net income attributable to the Groupe amounted to 313 million euro at June 30, 2018, versus 387 million at June 30, 2017.

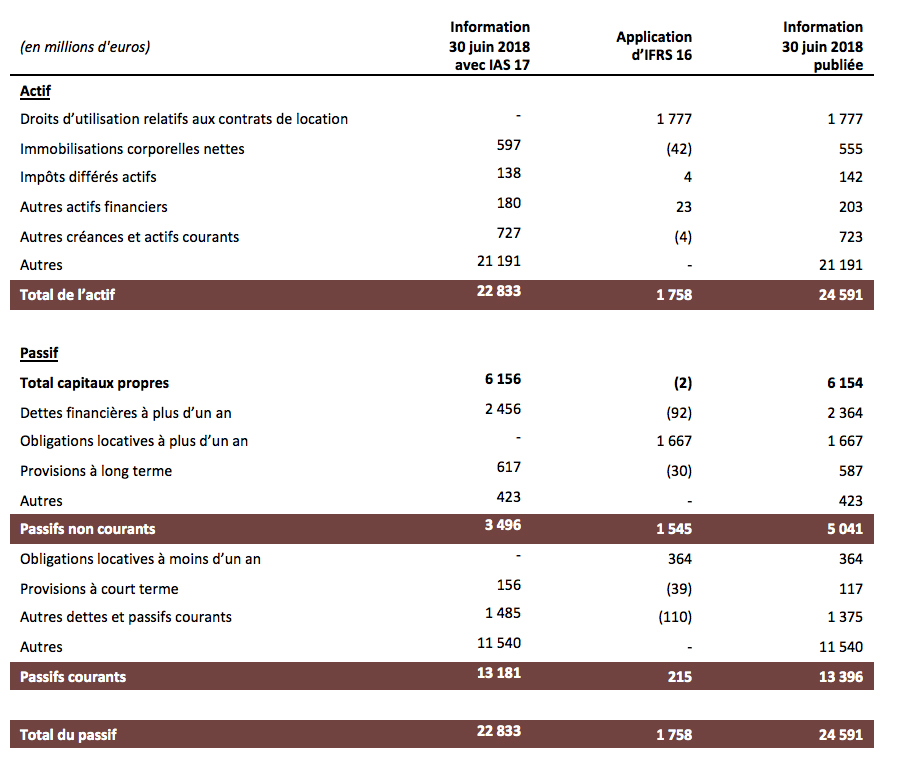

When IFRS 16 is applied, the Operating margin stands at 617 million euro, and the percentage operating margin for the period is 14.4%. By region, the Operating margin then becomes 12.4% in Europe, 17.4% in North America, 9.9% in Asia Pacific, 8.2% in Latin America and 1.6% in the Middle East & Africa.

The Operating income was 458 million euro in H1 2018.

After IFRS 16, Financial income (expense) was an expense of 36 million euro in H1 2018 after inclusion of lease obligations totaling 29 million euro.

Income tax was 109 million euro when the 2018 forecast effective tax rate of 25.9% was applied.

Overall, net income attributable to the Groupe amounted to 301 million euro (after IFRS 16) at June 30, 2018.

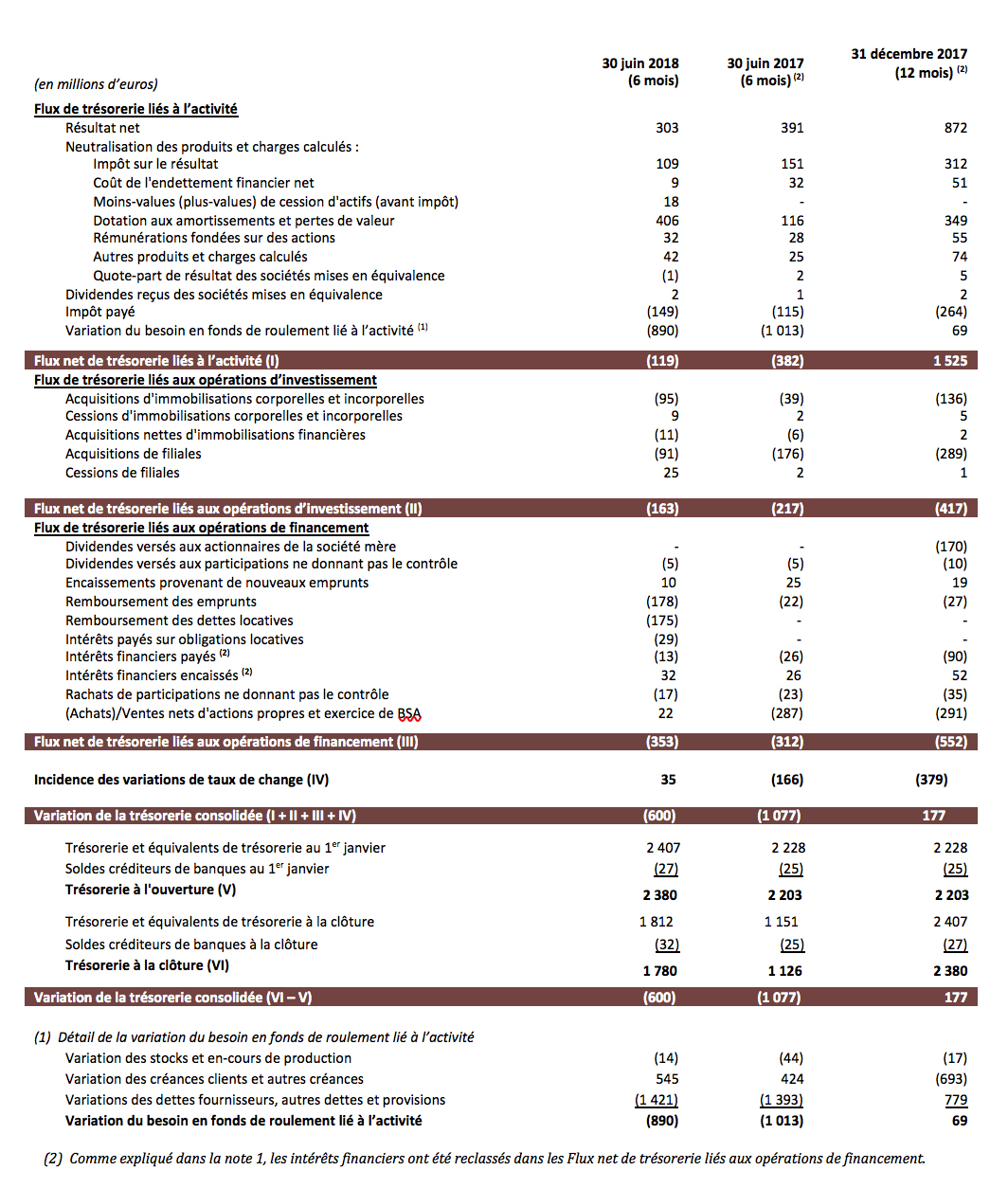

Free Cash Flow

The Groupe’s free cash flow, before application of IFRS 16 and excluding variations in working capital requirements, decreased by 16% compared with the previous period to stand at 499 million euro. At constant exchange rates, it fell 8%. This decline was due to higher capex and the higher level of tax paid. Investments rose to 86 million euro versus 37 million euro in the first half of 2017. The increase in H1 2018 includes investments made under the All in One real estate program. Income tax paid rose from 115 million euro in H1 2017 to 149 million euro in H1 2018. Also, while the Groupe received a tax refund in H1 2017, the first half of 2018 marked the first payment of the toll charge (payment spread over an eight-year period) for 18 million euro. After application of IFRS 16, free cash flow amounted to 500 million euro.

Net debt

At June 30, 2018, net debt totaled 1,136 million euro, up from 727 million euro at December 31, 2017. The substantial debt reduction (close to 1 billion euro) over the last 12 months can be attributed to strong cash flow generation combined with very strict control of variations in working capital requirements. In fact, the increase in working capital requirements was limited to 889 million euro in H1 2018, after an increase of 1,013 million euro in H1 2017. In H1 2018, the Groupe’s average net debt stood at 1 405 million euro, after 1,993 million euro in the first half of 2017.

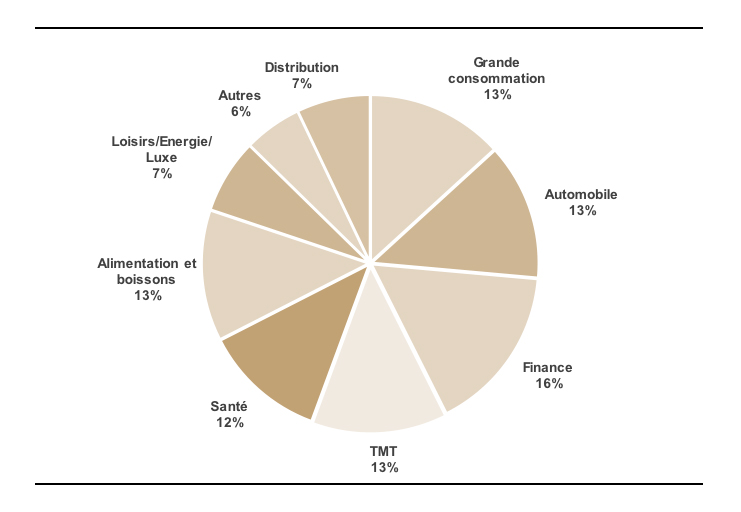

Sprint To The Future

Since 2014 and the acquisition of Sapient, Publicis Groupe has been undergoing a deep transformation and is now uniquely positioned thanks to three key differentiation points:

Sprint To The Future is Publicis Groupe’s strategy and execution plan for 2018-2020 and is based on three pillars:

1. To provide each client with the keys to its future success: one-to-one consumer engagement at scale, and three strategic game changers, namely data, dynamic creativity and digital business transformation expertise.

2. A sprint to accelerate the Groupe’s transformation, notably through the deployment of Global Client Leaders, the roll-out of a country-by-country organization, and an “invest in growth” plan funded by a major cost-cutting program.

3. Greater value to shareholders during the transformation, by accelerating organic growth and the percentage operating margin.

For further details, see the Groupe’s press release dated March 20, 2018:

http://www.publicisgroupe.com/en/news/press-releases/publicis-2020-sprint-to-the-future-en-1

First results are very encouraging. net revenue of Strategic Game Changers is up 27% in the course of the first 6 months of 2018, validating the strategic decisions of the Groupe. Net revenue generated with the first 100 clients of the Groupe amounted to 450 million, representing 18% of net revenue of the top 100 clients.

Publicis Groupe appointed 46 Global Client Leaders as of June 30, compared with 35 end 2017 and an objective of 100 by 2020. The objective to achieve 100% of net revenue under country model was reached at the end the first half of 2018, with the implementation around 8 key markets: France, United Kingdom, DACH (Germany, Austria, Switzerland), Central & Northern Europe, Southern Europe, North America, Latin America, Asia Pacific & Middle East / Africa. This organization will aim at accelerating Groupe’s growth and delivering efficiency gains.

Headcount in global delivery platform was 9,100 at end June, versus 8,700 end 2017.

All the energy of the Groupe is mobilized to execute its strategy and to deliver greater value to its clients, its people and its shareholders. A dedicated incentive plan, fully aligned with the objectives presented during the investor day, will be implemented for the group of executives in charge of the execution of the plan.

Disposal

Publicis Groupe finalized the disposal of Genedigi during the second quarter of 2018.

Publicis Groupe remains focused on three priorities: to deliver the results announced year after year, to accelerate its transformation by rolling out its model at scale, and to create shareholder value throughout the period. The first half-year 2018 yielded a marked improvement of its percentage margin, double-digit growth (at constant exchange rates) of headline EPS, and a strengthening of its financial position. Business gains in the first quarter should lead to higher organic growth than in 2017. Concerning the margin, cost saving efforts will be continued, and part of the savings achieved will be reinvested to establish the basis for sustained future growth. Overall, the margin can be expected to increase by 30 to 50 basis points in 2018.

In the longer term, Publicis Groupe intends to deliver greater value to shareholders by accelerating the growth of its headline diluted EPS over 2018-2020, using three levers:

The objective is to accelerate organic growth over 2018-2020 with the ambition of achieving +4% by 2020.

Publicis Groupe is also aiming to increase its percentage operating margin by 30 to 50 basis points per annum between now and 2020. This objective includes a 450-million euro cost savings plan fully aligned with the Groupe’s strategy. This cost savings plan will serve to fund a 300-million euro operational investment program spanning 2018-2020, a plan that is primarily dedicated to the Groupe’s talent through hiring, training, development and re-skilling.

Publicis Groupe is targeting 5% to 10% annual growth of its headline diluted EPS, ramping up over the next three years, at constant exchange rates, through continuous enhancement of its organic growth, improved margins and the contribution of acquisitions to earnings.

Free cash flow generation is expected to remain strong and the Groupe’s balance sheet will remain solid. With a payout ratio in the region of 45%, dividend growth can be expected to accelerate over the next three years.

This enhanced financial performance will place Publicis Groupe at the forefront of the market in marketing and business transformation.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These forward-looking statements and forecasts are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the Registration Documents filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavorable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Publicis Groupe has applied IFRS 15 “Revenue” accounting standard since January 1, 2018. Details of 2017 quarterly and full year revenue before and after IFRS 15 impact, 2017 net revenue by quarter and by geography, and the main items of 2017 half year and full year results before and after IFRS 15 impact, have been disclosed in a press release dated July 6, 2018.

Publicis Groupe has applied IFRS 16 “Leases” accounting standard in advance, as of January 1, 2018. Publicis has retained the “prospective method” allowed by the accounting standard by which the cumulative effect of the standard will be accounted for as an adjustment to the opening equity, considering the “right of use” asset equals the amount of the lease commitment, adjusted for rents paid in advance. The opening balance sheet with the application of IFRS 16 as of January 1, 2018 have been disclosed in a press release dated July 6, 2018. Besides, the 2017 consolidated income statement will not be restated. The Groupe will communicate 2018 half-year and full-year results including IFRS 16 and will provide those financial items excluding IFRS 16.

Mercedes-Benz (Global), Campbell Soup Company (USA), Ricola (Global), Swarovski (France), Zhuyeqing Tea (China), Carrefour (China), Luzhou Laojiao, Whitail (China), Adobe (India), Asics (Singapore), P&O Ferries Holdings (UK), Department of Transport and Main Roads - Queensland Government (Australia), Lapp Holding AG (Germany), Hotwire (USA), Sentosa (Singapore), ABInBev (USA), Muthoot Pappachan Group (India), Kraft Heinz (China), Tourism Fiji (Global)

(Norway), Didi Chuxing (China), Etisalat Misr (Egypt), Henryk Kania (Poland), Iberdrola (Norway), LT Grp (Philippines), Lucano Group (Italy), Marriott International (Global), Maspex (Poland), Mcdonald's (Middle East), Mondelez International (North America), NBC Universal/Telemundo (USA), Ola (India), Pirelli (Global), Pizzardi Editore (Italy), Red Bull (USA), The Body Shop (Singapore), ZEE5 (India), Banyan Tree (Singapore), Coty (China & South East Asia), Dunkin' Donuts (USA), Glovo (Italy), IKEA (MENA), L'Oreal (Mexico), Macy's (USA), McDonald's (France & Latin America), NBCU Universal Kids (USA), Nonno Nanni (Italy), Sensee (France)

Carrefour (Global), Marriott International (Global), Mercedez Benz (Global)

Marriott International (LATAM), Mercedes Benz (Colombia, Argentina, Regional), Daimler (Korea, Greece, Hungary, Czech republic, Turkey, Belgium), Hochalnd (Romania), Central Beverage Company (Israel), Mercedes (Portugal), Eviso (Belgium), VISA (Argentina), Nestlé (Chile), McDonalds (LATAM- Regional), IKEA (South Korea), Petronas (Malaysia), Kering (Japan)

Alexion Pharmaceuticals (USA), AVANIR Pharmaceuticals (USA), DBV Technologies (USA), Eli Lilly & Co. (USA), Galderma (USA), ParatekPharmaceuticals (USA), Pfizer Inc. (UK & USA), Roche (USA), Astrazeneca (USA), Bayer (USA), Bristol-Myers Squibb (USA), EyePoint Pharmaceuticals (USA), Masimo Corporation (USA), Merck & Co. (USA), Novo Nordisk (USA), Merz Aesthetics (USA), Proctor & Gamble (USA), Rhythm Pharmaceuticals (Europe), Sarepta Therapeutics (USA)

05-01-2018 Publicis Groupe half-year financial statement liquidity contract

22-01-2018 Nick Law Joins Publicis as Chief Creative Officer of Publicis Groupe and President of Publicis Communications

23-01-2018 Carrefour group signs strategic partnership with Publicis.Sapient to accelerate its digital transformation

23-01-2018 Press release “Anonymous Letter”

29-01-2018 Publicis Groupe and Microsoft Announce Partnership for Marcel AI Platform

01-02-2018 Publicis Groupe Announces Global Leadership Promotions Across its Solutions & Regions

01-02-2018 Loris Nold appointed to the newly created role of CEO of Publicis Groupe APAC

01-02-2018 Alexandra von Plato Appointed Chief Executive Officer of Publicis Health

08-02-2018 Publicis Groupe : 2017 Annual Results

14-02-2018 Viva Tech 2018

14-02-2018 Leo Burnett Chicago Names Kieran Ots EVP, Executive Creative Director

26-02-2018 Robett Hollis and FrontSide join Saatchi & Saatchi New Zealand

28-02-2018 Saatchi & Saatchi New Zealand wins global Tourism Fiji account

05-03-2018 Brill and Crovitz announce launch of NewsGuard to fight fake news

20-03-2018 Publicis 2020: Sprint To The Future

27-03-2018 Publicis Groupe Named 2018 Adobe Experience Cloud Partner of the Year

29-03-2018 Publicis Media launches Global Commerce capability to manage the intersection of media and marketplaces

10-04-2018 Leo Burnett wins international Betfair account

19-04-2018 Publicis Groupe: Q1 2018 revenue

23-04-2018 2017 Registration Document available

25-04-2018 Publicis Groupe appoints leadership team to lead Indian market

30-04-2018 Publicis Media aligns EMEA & APAC markets under unified leadership

24-05-2018 Publicis Groupe unveils Marcel

28-05-2018 Combined General Shareholders’ Meeting

13-06-2018 Tom Kao appointed as Publicis Groupe Hong Kong CEO

22-06-2018 Publicis Groupe clients champion creativity in Cannes

26-06-2018 Publicis Groupe appoints Raja Trad to the newly created role of Chairman Middle East

Net revenue or Revenue less pass-through costs: Pass-through costs mainly concern production and media activities, as well as various expenses incumbent on clients. These items that can be re-billed to clients do not come within the scope of assessment of operations, net revenue is a more relevant indicator to measure the operational performance of the Groupe’s activities.

Organic growth: Change in net revenue excluding the impact of acquisitions, disposals and currencies.

EBITDA: Operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex : Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

Free Cash Flow before changes in working capital requirements: Net cash flow from operating activities less interests paid & received, repayment of lease liabilities & related interests and changes in WCR linked to operating activities

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / Headline diluted EPS.

The impacts of the first application of IFRS 16 on the opening balance sheet are the following:

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 103,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS