Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

07/21/2016, Paris

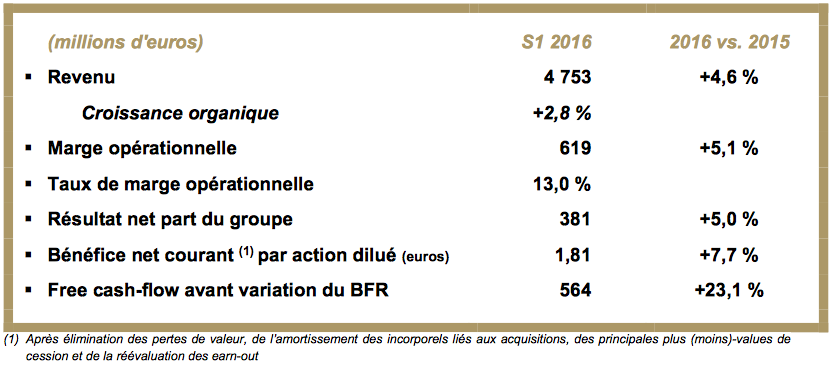

“This first half-year has ended very satisfactorily.

First with the results: organic growth of close to 3%, an operating margin at 13% and a double- digit increase of our free cash flow. Next the implementation of our new structure, the “Power of One” by the end of June, as expected.

The transformation process launched in December 2015 has completely changed our approach to communications and our understanding of the way our clients work in taking on the challenges of the future. This transformation means we can anticipate our clients’ expectations with an “end- to-end” offering that provides them with full access to the Groupe’s resources including our skills in consulting and technology. This initiative was very well received by our clients as it is original, modern and, most importantly, it is a comprehensive solution to the challenges they face. We are beginning to reap the benefits of this new approach.

Some expected this transformation would require several years to be implemented. I would like to express my gratitude to all our people who have had to contend with upheaval within the organization, reassignments, or changes in responsibility while, at the same time, continuing to provide our clients with Publicis service at its very best. Despite our concerns of seeing significant impact from the budgets lost in 2015, they were able to ensure new business developments which brought us to a satisfactory growth rate in the 2nd quarter.

Furthermore, they also left no stones unturned in ensuring the success of other Publicis initiatives such as Viva Technology, an undertaking organized in conjunction with Groupe Les Echos. This event was further evidence of the Groupe’s interest and involvement in the digital economy and innovative ideas, and of the importance it places in supporting start-ups that are the companies of the future. The great success of this event is also a testament to the Groupe’s credibility in this sector and in the eyes of the major players. During this event, our “Publicis90” project rewarded 90 start-ups with financial support: this was our way of celebrating Publicis’ 90th anniversary in a constructive and forward-looking manner. It should also be noted that 25 of the 90 winners came from within the Groupe, further evidence of the entrepreneurial spirit that reigns within the Groupe.

Finally, during Viva Technology, Publicis Groupe and Tencent – the Chinese internet giant – announced a strategic agreement at global level. This partnership further reinforces our leadership in digital and technology.

After this particularly active and productive first half-year, we expect the third quarter to be more difficult due to the full impact of the account losses of 2015, though this should not jeopardize the upward trend of all the Groupe’s indicators over the full year 2016.

We should not be heavily impacted from the Brexit. Since we operate in the UK in local currency, as we do in all the countries in which we have operations.

We remain very confident about reaching our 2018 objectives, and believe that we will start to see and feel the benefits of our transformation more fully as of 2017.”

Publicis Groupe’s Supervisory Board met on July 20, 2016 under the chairmanship of Mrs. Elisabeth Badinter, to examine the accounts for the first half of 2016, presented by Mr. Maurice Lévy, Chairman of the Management Board and Chief Executive Officer.

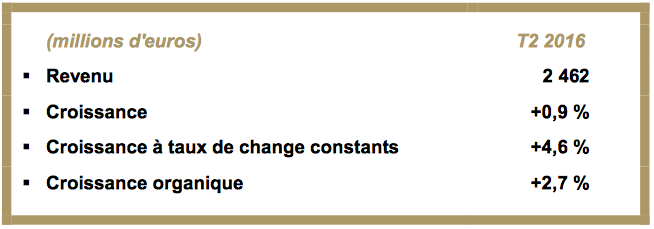

2.1 – Q2 2016 revenue

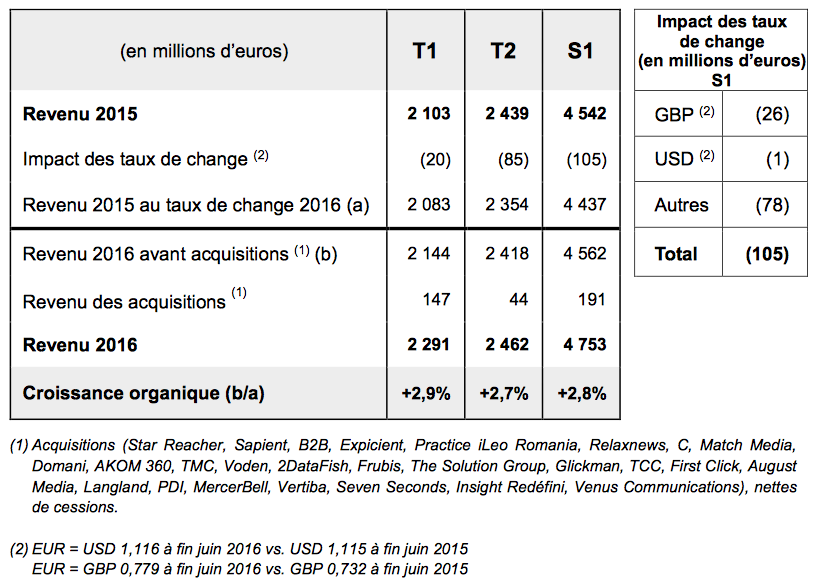

Publicis Groupe’s consolidated revenue for the second quarter of 2016 was 2.462 million euro, up 0.9% from 2,439 million euro in Q2 2015. Exchange rates impacted revenue negatively by 85 million euro, i.e. the equivalent of 3.5% of Q2 2015 revenue. Net acquisitions contributed 44 million euro in revenue in Q2 2016, the equivalent of 1.8% of Q2 2015 revenue. Growth at constant exchange rates was +4.6%.

Organic growth was +2.7% in the second quarter, buoyed by the growth of digital activities (+5.1%). Development efforts allowed to significantly mitigate the impact of the loss of media accounts of 2015. However, the impact of these losses should be much greater in the third quarter.

2.2 – H1 2016 revenue

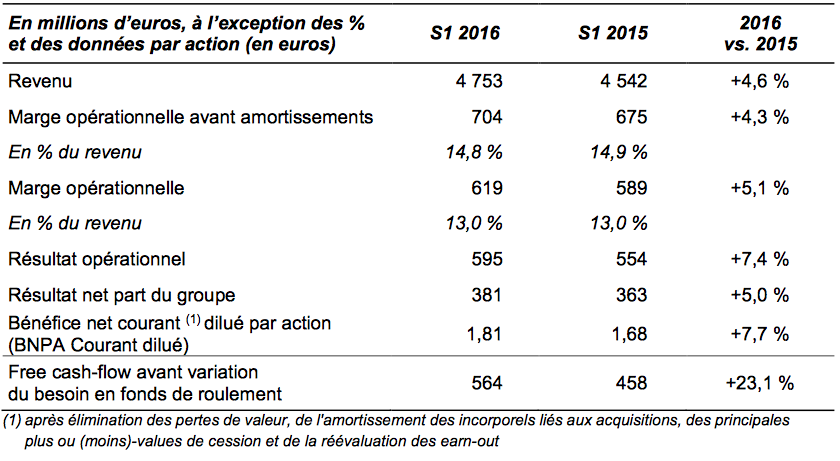

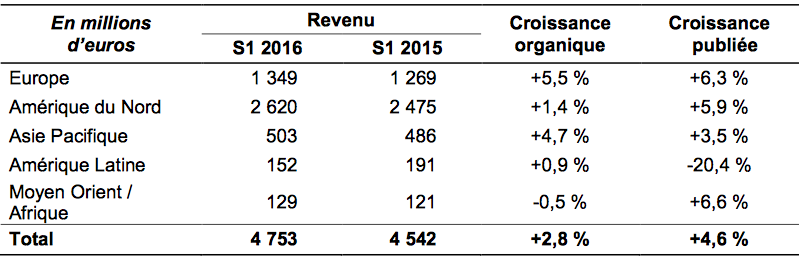

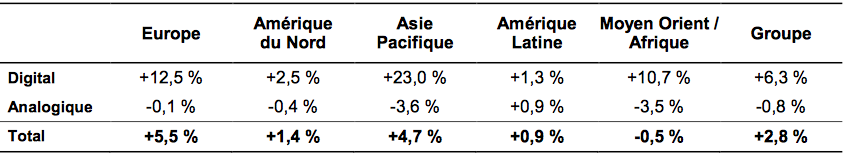

Over the first half-year, Publicis Groupe’s consolidated revenue totaled 4,753 million euro compared with 4,542 million euro in 2015, i.e. an increase of 4.6%. The impact of exchange rates was a negative 105 million euro, i.e. the equivalent of 2.3% of H1 2015 revenue. Net acquisitions contributed 191 million euro to revenue in the first half of 2016, i.e. the equivalent of 4.2% of H1 2015 revenue. Growth at constant exchange rates was +7.1%, and organic growth stood at +2.8% for the first half of 2016. It should be noted that the Healthcare sector performed well, and that the Media business continued the sustained momentum built up in Q1 2016 despite the impact of the accounts lost in 2015.

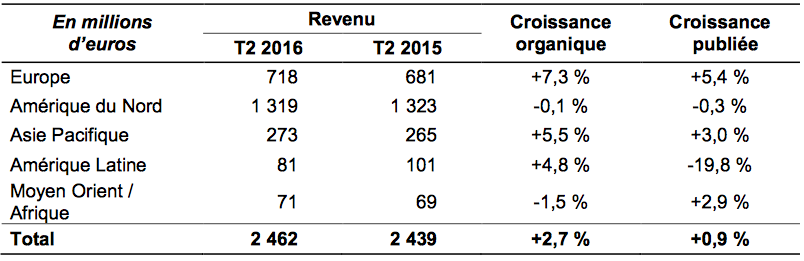

Europe grew its revenue by 6.3%. When the impact of acquisitions and exchange rates is factored out, organic growth was +5.5%. Over the entire region, digital achieved strong growth (+12.5%). France continued to perform well (+5.0%) and Germany and Italy continued their strong momentum (growth in the region of 9%), shored up by better economic situations. The situation was volatile in Russia with 4.6% growth at June 30, after 9.4% in the first quarter. The situation is much improved in the UK where growth was 3.6% in H1 (7.4% in Q2).

North America reported growth of 5.9% with organic growth standing at +1.4%. This growth stemmed mainly from the media and health businesses. Growth was nevertheless impacted by the 2015 media account losses (Mediapalooza).

Asia Pacific achieved reported growth of 3.5% and organic growth of 4.7%, with good levels of performance in Greater China (+4.4%).

Latin America was down 20.4% on a reported basis but recorded positive organic growth of 0.9%. This downturn was notably attributable to the downswing in Brazil (revenue fell 4.6% despite business stabilizing in the second quarter at -0.7%). Conversely, Mexico returned to positive growth once again with +11.5% in H1 (after -14.6% in the first quarter).

The Middle East & Africa achieved reported growth of +6.6% but negative organic growth of - 0.5%.

The Groupe’s growth continued to be driven by its digital activities (organic growth of +6.3%), with double-digit growth in all regions except North America – where the Groupe is still experiencing difficulties with Razorfish – and Latin America. It should also be pointed out that analog activities continued to decline.

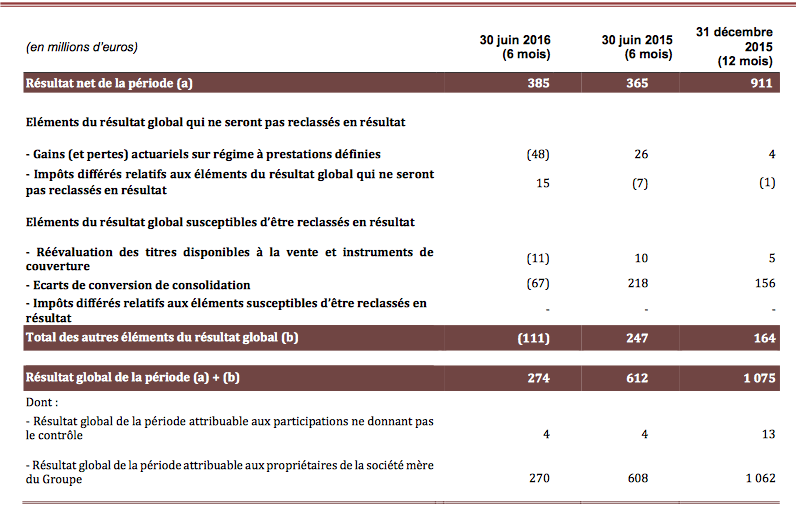

3.1 - Income Statement

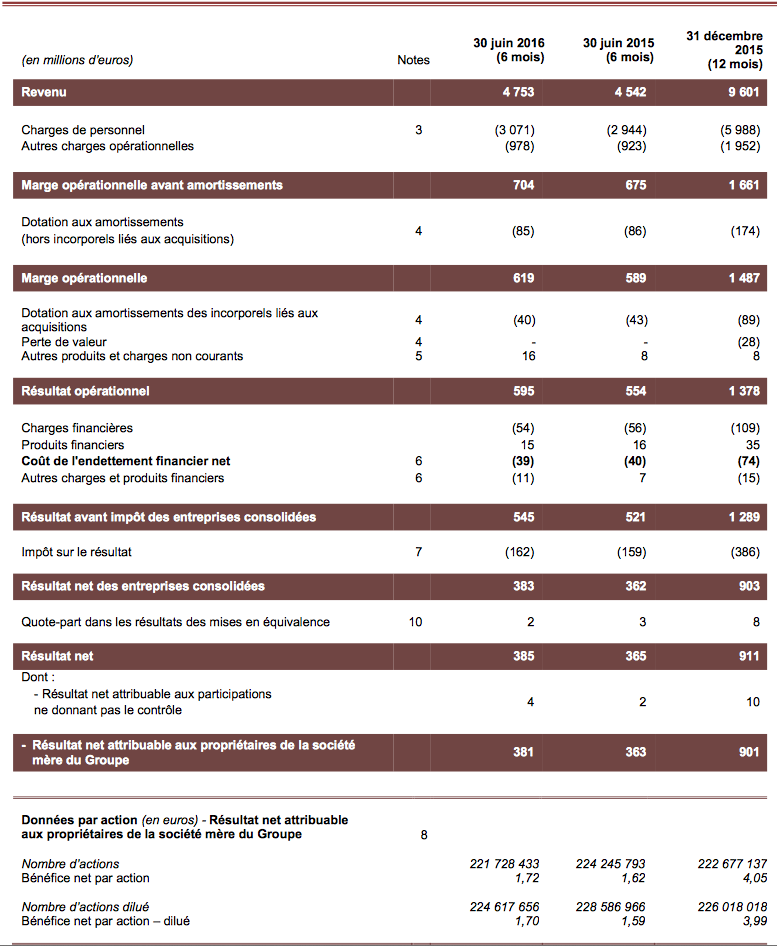

The Operating margin before depreciation and amortization rose to 704 million euro in H1 2016, up 4.3% from 675 million euro for the corresponding period in 2015, i.e. 14.8% of revenue (versus 14.9% in H1 2015).

Personnel costs amounted to 3,071 million euro at June 30, 2016, up 4.3% from 2,944 million euro for the corresponding period in 2015. Fixed personnel costs totaled 2,676 million euro, representing 56.3% of revenue after 57.1% in 2015. Freelance costs stood at 219 million euro in H1 2016, compared with 197 million in H1 2015. Restructuring costs rose by 16 million to total 55 million euro in H1 2016 (versus 39 million euro in H1 2015) as the Groupe undergoes its reorganization and adjusts to an environment that is increasingly digital-oriented, while continuing to generate synergies subsequent to the Sapient acquisition. Operational efficiency will be improved by the various projects in which the Groupe is investing (ERP roll-out, the development of production platforms, the continued regionalization of its Shared Services Centers, as well as various technological developments).

Other operating costs (excluding depreciation and amortization) totaled 978 million euro after 923 million euro in H1 2015, i.e. 20.6% of total revenue versus 20.3% in 2015.

Depreciation and amortization totaled 85 million euro in H1 2016, compared with 86 million euro in the first half of 2015.

The Operating margin rose 5.1% to 619 million euro, after 589 million euro in H1 2015. As a percentage of revenue, the margin was 13.0%, i.e. the same percentage as for the corresponding period in 2015.

By region, the operating margins were 13.0% in Europe, 14.1% in North America, 11.1% Asia- Pacific, -0.7% in Latin America and 14.7% in the Middle East & Africa.

Amortization of intangibles arising from acquisitions totaled 40 million euro in H1 2016, down from 43 million euro in H1 2015. Other non-recurring income (expenses) netted out at income of 16 million euro, mainly in the form of capital gains on Mediavision disposal, after 8 million for the corresponding period in 2015.

Operating income for the first six months of 2016 amounted to 595 million euro, up 7.4% from 554 million euro in H1 2015.

Financial income (expense), which comprises the cost of net debt and other financial income and expenses, was a net expense of 50 million euro in the first half of 2016, after an expense of 33 million euro in 2015. The cost of net debt was quite stable by comparison with last year (39 million euro in H1 2016 versus 40 million euro in H1 2015). Other financial income (expense) amounted to income of 11 million euro (mainly due to the revaluation of earn-out payments), after income of 7 million euro in H1 2015.

Income tax for the period was 162 million euro, i.e. an estimated effective tax rate of 29.7%, compared with 159 million euro in 2015, corresponding to an effective tax rate of 30.5%.

The Associates share of profit was 2 million euro versus 3 million euro in H1 2015. Minority interests totaled 4 million euro in 2016, after 2 million euro in H1 2015.

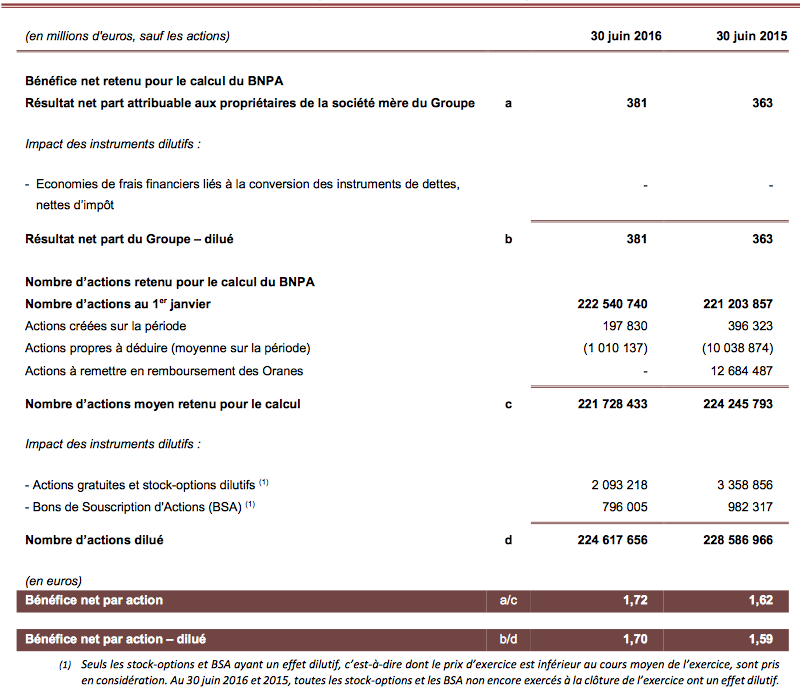

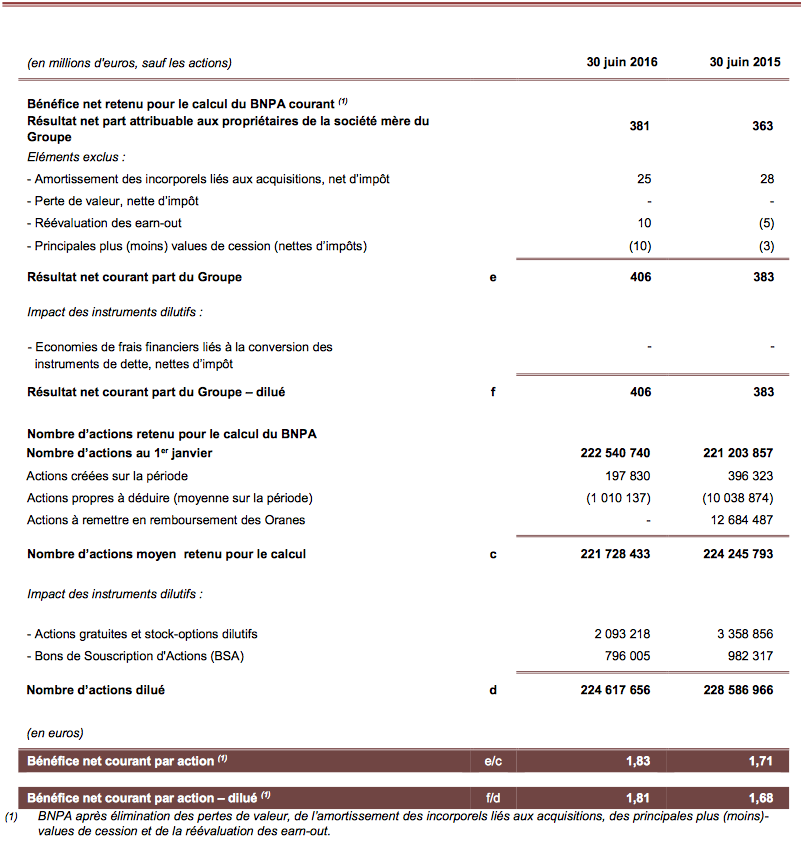

In total, group net income amounted to 381 million euro in the first half-year 2016, compared with 363 million euro for the corresponding period in 2015.

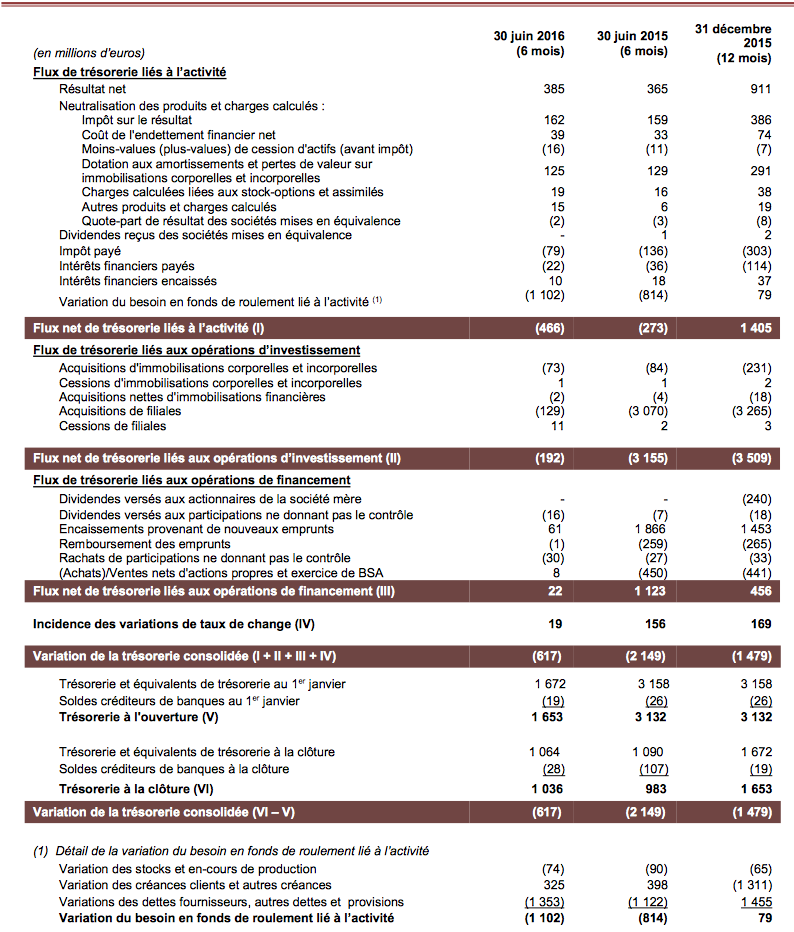

3.2 - Free cash flow

Before changes in working capital requirements, the Groupe’s free cash flow was 564 million euro in H1 2016, compared with 458 million euro in 2015.

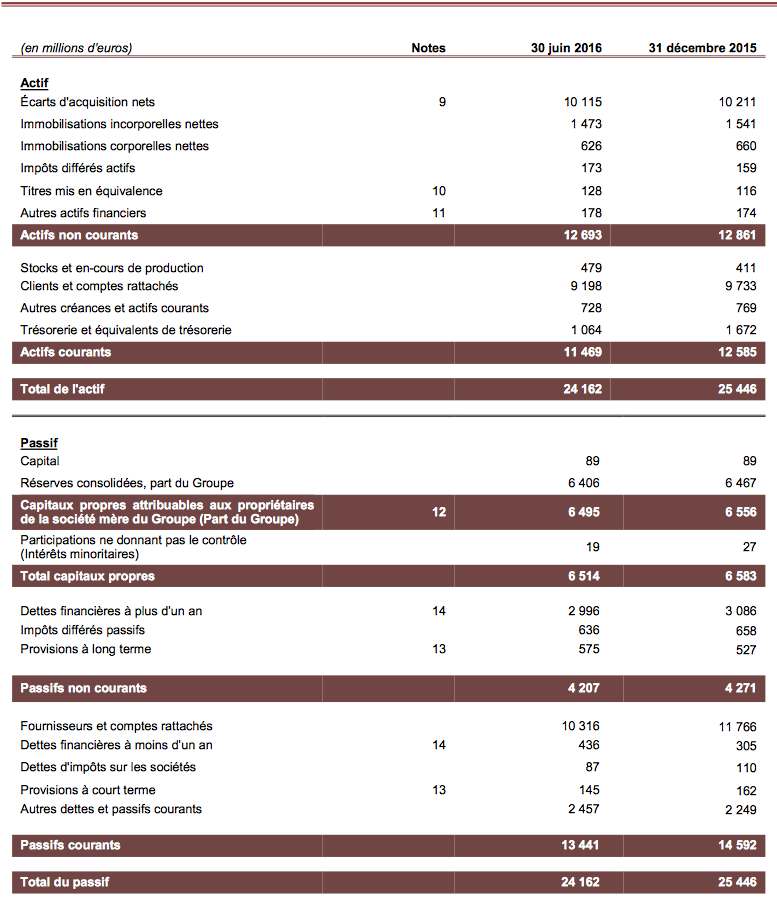

3.3 – Net debt

Net debt at June 30, 2016 stood at 2,460 million euro (i.e. a debt / equity ratio of 0.38) compared with 1,872 million euro at December 31, 2015. The Groupe’s average net debt in the first half of 2016 was 2,380 million euro, versus 1,881 million euro for H1 2015. For the record, the Sapient acquisition was completed on February 6, 2015.

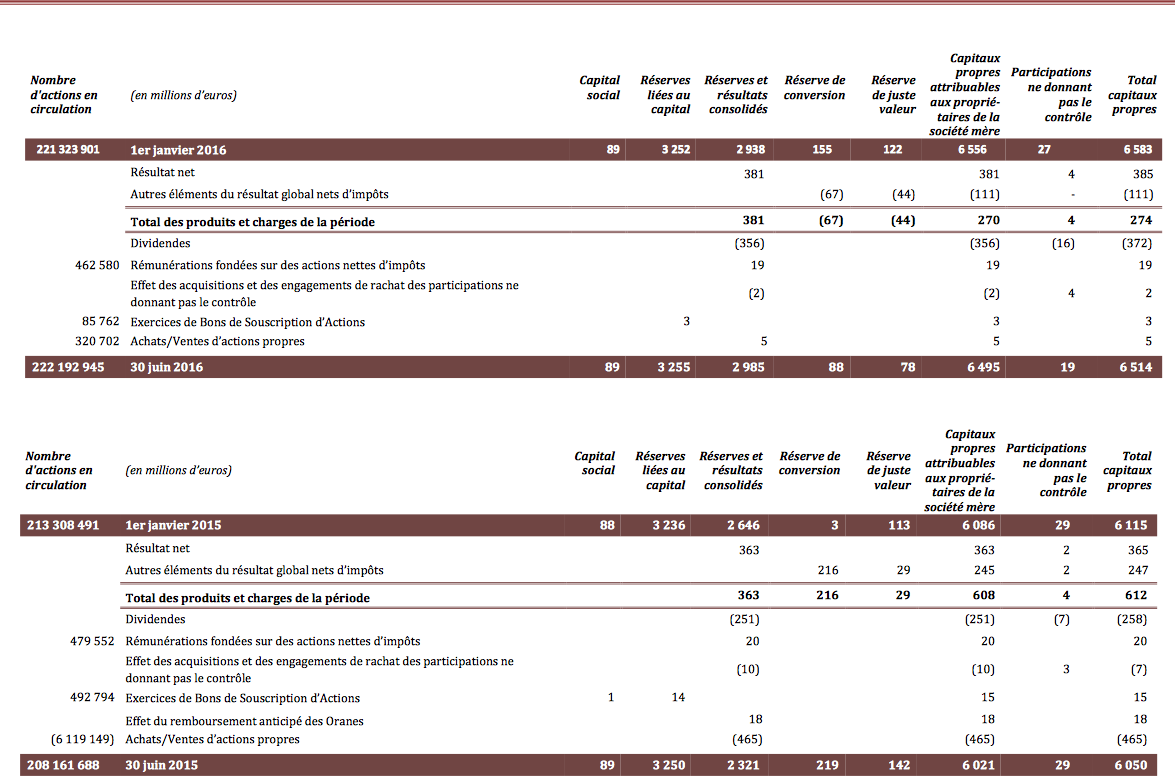

3.4 - Shareholders’ equity

Consolidated shareholders’ equity attributable to the Groupe decreased from 6,556 million euro at December 31, 2015 to 6,495 million euro at June 30, 2016.

In 2016, Publicis Groupe is continuing its in-house analysis of the Sustainable Development Goals (SDGs) in order to identify the best themes to work on, whether independently or in partnership with others. This is the backdrop against which the Groupe is taking part, alongside five other major communications groups, in “Common Ground” which is the first sectoral initiative in favor of the UN’s Sustainable Development Goals.

The Groupe’s CSR Report is structured around its three main stakeholder groups: Talent, i.e. employees; Clients; and Society, i.e. citizen-consumers. The cross-cutting fields of ethics and governance, on the one hand, and environmental matters on the other hand, are dealt with in two separate chapters.

Concerning talent, the Groupe is taking up the major challenges of diversity and inclusion, and continues, for instance, to roll out affinity networks locally (e.g. VivaWomen! or Egalité). It also continues to work on challenges such as professional development and continuing training, or well-being in the workplace. Several initiatives have been launched, in particular in training.

As for clients, the challenge for the agencies is to increase their involvement in responsible marketing and communications through efficient new approaches, while supporting clients in their digital transformation where innovation is at the very heart of their concerns. The supplier CSR assessment program has been implemented, and 100 suppliers (out of the 150 who were invited) have chosen to join the EcoVadis platform. The CSR Procurement Guidelines are now available on the Groupe’s website.

In terms of Society and consumers-citizens, a Chief Data Privacy Officer has now been appointed to address the issues and take up the challenges of data protection.

The Groupe’s agencies continue to work actively with local communities, with pro bono campaigns (provided free of charge) and volunteer work now coming under a single watchword: Create & Impact. The goal is to boost the positive impact we bring to Society and to reassert our commitment to human rights. Over the first half-year, the Women’s Forum for the Economy & Society has held events in Mexico, Dubai and Mauritius, with considerable regional impact and close attention to recurring issues with which women are faced in these regions and countries.

In Ethics, the focus has been on updating the procedures supporting Janus, the in-house code of ethics, as well as collaborative work carried out within inter-professional organizations at national and international levels.

Finally, the Groupe is pursuing its ongoing efforts to contain and reduce its impact on the environment. The ambition is to “consume less and better”. The 2020 goals for the reduction of our carbon footprint are guided by the EU policy known as “20-20-20”.

The 2015 CSR Report has been independently audited in compliance with the GRI-4 framework, and includes more information and indicators than the 2015 Registration Document. The 52 agencies audited on site represent 35% of total headcount and all consolidated data were checked and audited. The CSR reporting process began in late 2015 and continued throughout the first quarter of 2016.

5.1 - Transformation

During the first six months of 2016 Publicis Groupe implemented the most fully integrated organization in the entire sector, bringing down the curtain on the traditional holding company structure with siloed communications groups. For Publicis Groupe, the goal is to help clients by providing them with the means to succeed in their own transformation and optimize marketing performance through access to all of the Groupe’s capabilities across the “Power of One” organization.

The purpose of this reorganization is to endow the Groupe with a more client-centric structure. Four dedicated “solution hubs” have been set up to serve clients on a cross-cutting basis:

Publicis Communications, headed by CEO Arthur Sadoun, spans the creative and communications networks: Publicis Worldwide, Leo Burnett, Saatchi & Saatchi, BBH, Fallon, Marcel, MSL (public relations) and Prodigious (production)

Publicis Media is run by CEO Steve King, and encompasses media and connectivity skills: Starcom, Zenith, Mediavest ǀ Spark, Optimedia ǀ Blue 449, and the performance entities such as Performics

Publicis.Sapient is led by CEO Alan Herrick and covers the consulting / technology / digital spectrum: SapientNitro, Sapient Consulting, DigitasLBi and Razorfish

Publicis Health, under CEO Nick Colucci, combines all the entities working for laboratories and healthcare companies: DigitasHealth LifeBrands, Publicis LifeBrands, Saatchi & Saatchi Wellness, Publicis Health Media, Touchpoint Solutions

All these solution hubs operate in the top 20 markets. Elsewhere, Publicis One, headed by CEO Jarek Ziebinski, provides an integrated, one-stop organization in each country.

The solutions hubs are now fully operational. The Global Client Leaders have been appointed and are in charge of clients, across all capabilities, with direct accountability through client P&L.

The Groupe should reap the benefits of this reorganization in the forthcoming quarters.

5.2 –ANA report (Association of National Advertisers)

On June 7, 2016, the ANA (Association of National Advertisers) published a report incriminating business practices between communications agencies and advertisers. We can only be surprised by ANA’s choice in particular as this report is based on allegations and situations that refer to undisclosed companies and individuals and are then used to make very broad-based and unverifiable accusations. Publicis Groupe was keen to state its position. Publicis Groupe has very stringent in-house rules and regulations, including a Code of Ethics, which serves as a reference in controlling procedures and financial reporting. We constantly revise our working methods to ensure that they are best in class and our employees have to apply them rigorously. All contract negotiations with our clients include standards of transparency that they deem appropriate and we commit to fully abide by the terms of the contract we enter into alongside our clients.

5.3 – Change in perimeter

MercerBell is a leading Australian agency in the field of customer experience. MercerBell is specialized in CRM and digital strategy, creativity, content and technology, and will be integrated into Saatchi & Saatchi. This agency, which was founded in 1999, has a team of 65 professionals and a customer base that includes Toyota, Foxtel, Quantas, BT, Allianz and ASX.

Vertiba, the Salesforce partner, is specialized in marketing solutions. Founded in 2010, Vertiba is headquartered in Boulder, Colorado. Vertiba’s skills will be integrated into the Publicis.Sapient platform.

Seven Seconds, the London (UK) based e-commerce and digital specialist, was founded in 2013 and will be integrated into BBH. Its main clients are British Airways, Barclays, Boots, Tesco Retail and Tesco Bank.

Venus Communications, is one of the leading public relations agencies in Vietnam. Venus has been integrated into the MSL brand, which in turn is part of Publicis One in Vietnam. Over the last 10 years, Venus and MSL have worked together successfully on numerous assignments. The agency, which was founded in 1998, has over 40 employees and a prestigious client portfolio that includes MasterCard, FedEx, Rolls Royce, BAT, Mead Johnson and Sanofi.

Troyka Group: in which Publicis Groupe has taken a stake, is West Africa’s first fully integrated communications services group. The Troyka group is comprised of six agencies, i.e. Insight Communications, The Thinkshop, All Seasons Media, Media Perspectives, The Quadrant Company, and Hotsauce.

Starting out with Insight Communications in 1980, the Troyka group now has 300 employees over six agencies across the entire region. The Troyka agencies work with prestigious international brands such as Heineken, Shell, Samsung, Unilever, Google, P&G, Microsoft, Ford and Axa, as well as with national brands including Oando, Nestoil, Africa Investor, Jagal, and Olam.

Publicis Groupe has been investing regularly in Africa in recent years, in view of the high growth potential of this market. By way of this equity investment, Publicis Groupe will use Troyka to launch its network in Nigeria, thereby creating a powerful communications entity that will have a competitive edge in all skill sets in West Africa

On June 1, 2016, Publicis Groupe acknowledged the decision by JCDecaux to abandon the project to acquire the former’s 67% stake in the share capital of Metrobus due to demands made by the French competition authority (Autorité de la concurrence). In conjunction with Metrobus and JCDecaux (which still owns a 33% stake), Publicis Groupe will now examine all the options to provide Metrobus with the best possible conditions for its development.

5.5 – Global partnership with Tencent

Publicis Groupe has signed a global strategic partnership with Tencent, the internet giant that operates the most popular social and media platforms in China. The partnership is the first-of-its- kind collaboration across a global advertising group and all 11 products of Tencent, China’s largest internet company. It is also the first partnership that transcends the Groupe’s three solution hubs of Publicis Media, Publicis Communications and Publicis.Sapient. This agreement will cement the two groups’ relationship at a global level with a mission to breed innovations whilst offering clients all of Tencent’s innovations through a unique borderless approach built on three pillars:

Content: The two companies will partner on the co-creation and co-investment of web native content to drive unique content opportunities and new content models for key clients.

The IMF’s recent announcements underscore the uncertainties surrounding the global economic environment, on top of geopolitical risks. The result of the “Brexit” referendum on June 23, 2016 increases anxiety with respect to the impact of the exit out of Europe could have on the UK but more broadly on to Europe overall. The violent events in the US, France and Turkey add to those uncertainties. Despite this environment and the difficulties in certain sectors of the economy, the good results achieved by Publicis Groupe confirm its previous guidance of improved financial indicators across the board: revenue, operating margin, adjusted diluted EPS, and dividend payout, even though we expect a more difficult 3rd quarter.

The Groupe’s transformation is the most radical ever imagined in its sector. It is being carried out to meet clients’ new requirements brought about by the fierce competition ushered in by the development of digital technology. Digital has not only empowered consumers, it has caused the physical and digital worlds to converge, with the emergence of numerous newcomers that are completely challenging the established order. Publicis Groupe has abolished the notion of holding company with silo-type operating structures and now provides a complete array of services from consulting right up to the materialization of campaigns through the alchemy of creation and technology within an operating entity of “connecting company”.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. They are presented as at the date of this document and, other than as required by applicable law, Publicis Groupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publicis Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the 2015 Registration Document filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publicis Groupe (www.publicisgroupe.com), including an unfavourable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, the difficulty of ensuring internal controls, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Volkswagen (China), Mondelez gum & candy (China), Wetherm (Greater China), Marubi (Greater China), Snapdeal (India), Yakult (Brazil), Carrefour (Brazil), Wine (Brazil), Movida (Brazil), Cadillac (USA), P&G Dish (USA), Acer Global (South Africa), Morrisons (UK), P&G (UK), Nestlé (UK), Belimo (Switzerland), Duracell International (Poland), Samsung / Brown Goods (Poland), Mlekpol (Poland), Experian (UK), Asda (UK), Netflix (USA), Macy's (USA), Marubi (China), BAIC international (China), L'Oréal (China), Petco (China), Health Promotion Board (Singapore), Snapdeal (India), Yakult (Brazil), Carrefour (Brazil), WINE (Brazil), Lactalis (Brazil), Movida (Brazil), Ladbrokes (Australia), Walmart (USA)

Shine Lawyers (Australia), Metricon Homes (Australia), EziBuy (Australia), AFL (Australia), Crosby Texter (Australia), BMBS/Daimler (China), DBS (Singapore/China/India), Shangri-La (China/Hong Kong), EDB (Ingapore), Urban Clap (India), Gander Mountain (USA), Snapchat (USA), THE One (UAE/GCC), Lidl (Denmark), ORCHESTRA (France), VTECH (France), FinexKap (France), Generali (Switzerland), INLAC (Spain), Worten (Spain), Pepe Jeans (Spain), 4 Finance (Poland), SAB Miller (Poland), OBI (Poland), Frisco (Poland), Nomad Foods (Europe), Deutsche Bahn (Germany), Masmovil (Spain), Asda (UK), Anacor Pharmaceuticals (USA), Discover (USA), Dole (USA), Groupon (USA), Motorola (USA), SGM (China), Tmall/Alibaba (China), YouXin (China), Coca Cola (Russia), The Study Group (Australia), DJI (Global), Aviva (Global), Air France (Global SEO)

Mastercard (Australia), Sunsuper (Australia), Pinpoint (Australia), Angie’s List (USA), Time Inc. (USA), Whole Foods (USA), Travelers (USA), Cardinal Health (USA), Genetech (USA), TransAmercia (USA), J Jill (USA), Silicon (USA), Starbucks (USA), CSM Bakery (USA), Manulife (Canada), Kering (UK), PGA Europe (UK), Congstar (Germany), Clinique Men (USA), ABBVie (USA), HCA (UK), CBL & Associates Properties (USA), Michael Kors (USA), Huawei (China), RBS (UK), Gallagher Bassett (USA), Cybersource (USA), UPS (USA), Cigna (USA), Wakefern (USA), USC Shoah Foundation (USA), Kelloggs (UK), Under Amour (USA), Sony (USA)

Acer (Indonesia), Electronic City (Indonesia), JDID (Indonesia), Scotiabank (Chile), Histadrut (Israel), Arkia (Israel), Mediamarkt (Turkey), BSH Ikiakes Syskeves A.B.E. (Greece), Nestlé (Greece), Newsphone Hellas (Greece), Dutch Government (Netherlands), Meetic (Netherlands), Cortefiel (Belgium), MCM (Belgium), NortSails (Belgium), Teva (Belgium), Walmart (Guatemala)

13-01-2016 - Publicis Communications Announces Priorities & Key Appointments 28-01-2016

11-02-2016 - Leadership change at Leo Burnett Worldwide

03-03-2016 - 2015 annual results

10-03-2016 - Publicis.Sapient acquires Vertiba, a Salesforce Gold Consulting Partner

10-03-2016 - MSL acquires Venus Communications Ltd in Vietnam

17-03-2016 - Publicis Media Unfolds Its Organisation Powered by Four Global Brands - Starcom, Zenith, Mediavest | Spark, and Optimedia | Blue 449

24-03-2016 - Publicis Groupe Partners with The Troyka Group in Nigeria

31-03-2016 - Publicis Groupe Launches Sapient Inside: The Combined Power of Publicis Communications and the Publicis.Sapient Platform

31-03-2016 - Publicis Groupe Named the Most Attractive Employer in the Services Sector by the Randstad Awards

21-04-2016 - Publicis One Announces its Global and Regional Leadership Q1 2016 revenue

28-04-2016 - Publicis One announces its local leadership in Philippines

18-05-2016 - Publicis Media announces leadership in France

25-05-2016 - Combined General Shareholders’ Meeting

01-06-2016 - Publicis Groupe announces Chief Revenue Officer’s sabbatical to deal with family issue. Laura Desmond to return January 1, 2017

01-06-2016 - Decision by JCDecaux to abandon its proposed acquisition of 67% of the Metrobus share capital held by Publicis Groupe

07-06-2016 - ANA Report: Publicis Groupe Statement

13-06-2016 - Agreement with Samsung to end the discussions regarding a possible investment in Cheil Wordwide alongside associated collaboration

EBITDA: operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex: Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

ROCE (Return On Capital Employed): Operating Margin after Tax (using Effective Tax Rate) / Average employed capital. Capital employed include Saatchi & Saatchi goodwill which is not recognised in consolidated accounts under IFRS.

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / EPS.

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 103,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS