Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

02/11/2016, Paris

“2015 was a particularly busy year, especially with the integration of Sapient since the closing of the deal on February 6, 2015, the major repurposing process, the work stream on the Groupe’s transformation, not to mention the numerous media accounts up for review.

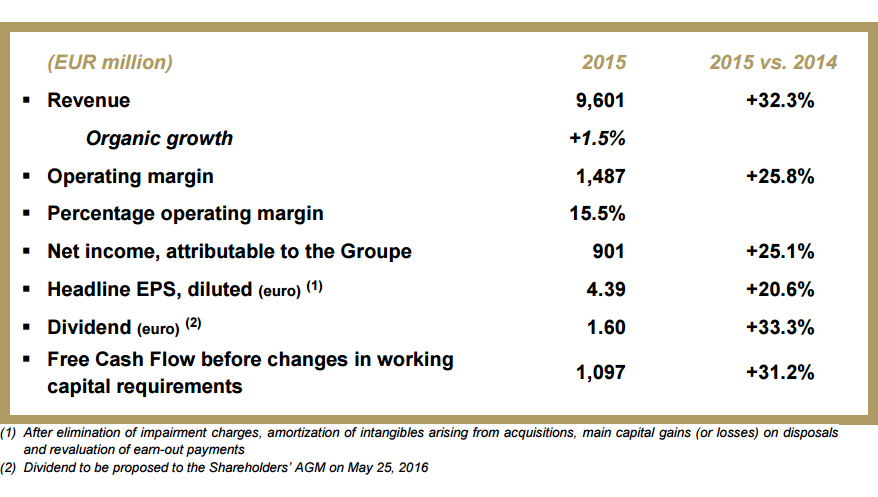

Under these circumstances, the Groupe’s performance was particularly good, in part thanks to the boost provided by acquisitions and exchange rates. The Groupe’s revenue grew by 32% (+19% before the favorable impact of exchange rates), and the operating margin reached 15.5% despite the dilutive effect of acquisitions and high restructuring costs. Net income rose 25%.

It might also be pointed out that free cash flow rose 31% to exceed the one billion euro mark for the first time in the Groupe’s history.

The fourth quarter, which is always more difficult to anticipate because of clients’ budget adjustments turned out to be better than expected. Organic growth reached +2.8% in Q4, driving annual growth to +1.5%. In fact, fourth-quarter performance proved quite satisfactory in North America where organic growth reached +6.3%. Organic growth of digital activities reached +8.8% in Q4. Over and beyond organic growth, all the indicators are positive.

Let me take this opportunity to thank all our clients for their trust in us and all our employees for their immense talent, their dedication and their energy at a time when demands are high. They had to take on the challenges of a hesitant global economy, our clients’ changing needs and our own transformation. Mention should also be made of the numerous innovations that bring about breakthroughs or even tipping points for our clients and that require them to transform themselves, just like us. Our own deep-rooted transformation is radically changing our structure and work patterns in order to provide our clients with the most complete array of fully integrated services, a unique alchemy of creativity and technology.

We have great confidence in the implementation of our new business model. It should enable us to meet the most demanding of client expectations and making us more competitive. The positive outcomes of recent collaborative undertakings testify to the fact that the organization we are putting in place is highly effective. We must now roll it out across the entire Groupe.

We have designed our model around the transition to digital that is obliging our clients to transform themselves. Our clients have always been at the very heart of our approach, but even more so now with this new organization that provides them with a complete array of solutions while seamlessly integrating the consulting and the technology in order to transform.

For all these reasons, 2016 will be a year of transition during which we anticipate to see modest organic growth, and focus on building foundations that will allow us to fire on all cylinders in 2017.”

Publicis Groupe’s Supervisory Board met on February 10, 2016, under the chairmanship of Mrs. Elisabeth Badinter, to examine the annual accounts for 2015 presented by Mr. Maurice Lévy, Chairman of the Management Board and Chief Executive Officer.

Publicis Groupe’s environment was one of marked slowdown in the emerging markets and a recovery in Europe that was below expectations. The overall global context was one of low growth and virtually non-existent inflation. With organic growth at 1.5%, the Groupe maintained strict control over its costs, thus enabling its free cash flow to exceed the one billion euro mark for the first time in its history.

2.1 – Q4 2015 revenue

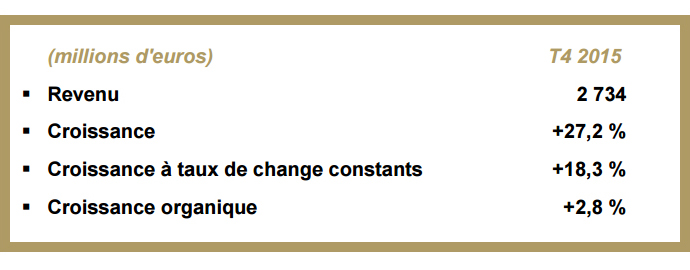

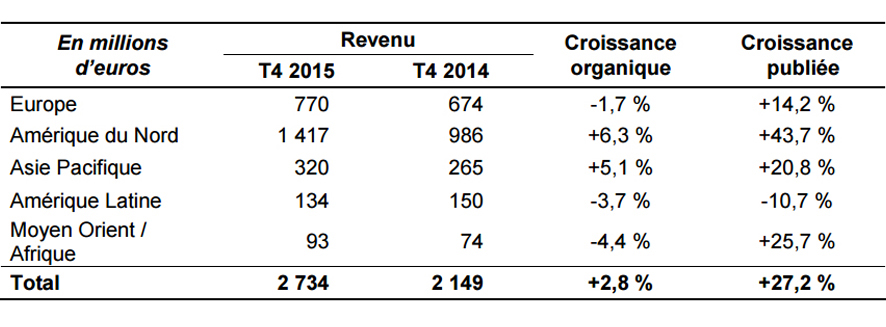

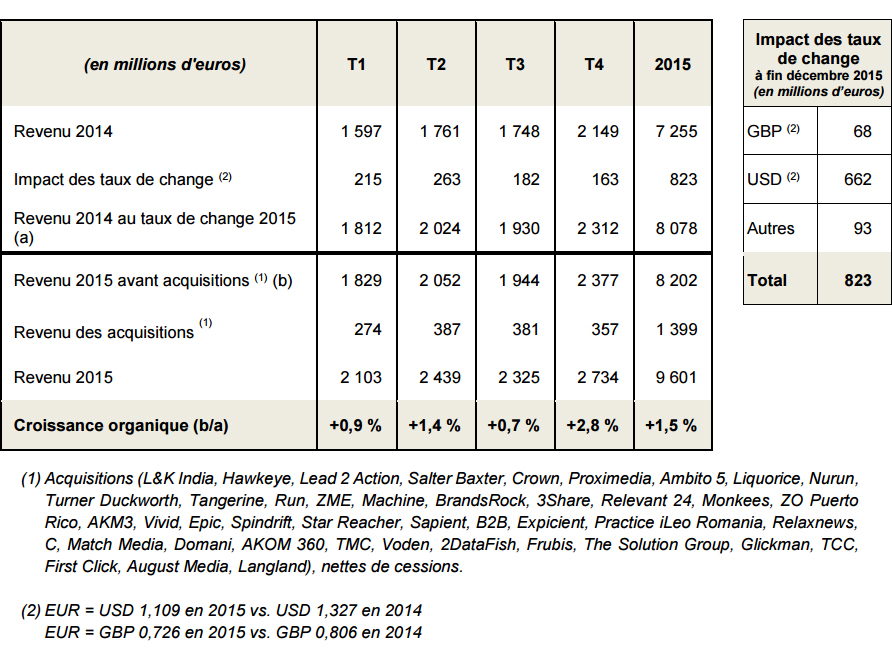

Publicis Groupe’s consolidated revenue in Q4 2015 was 2,734 million euro, up 27.2% from 2,149 million euro in Q4 2014.

With close to 60% of the Groupe’s revenue exposed to the dollar and sterling, exchange rates had a 163 million euro positive impact on revenue, i.e. 7.6% of Q4 2014 revenue. Acquisitions (net of disposals) contributed 357 million euro, i.e. 16.6% of Q4 2014 revenue. At constant exchange rates, growth was 18.3%.

Organic growth stood at +2.8%, shored up by digital activities and the very good dynamics in North America. Europe, however, saw its growth decline, particularly in France as a result of the November events in Paris which led to a freeze on advertising investments.

2.2 – 2015 revenue

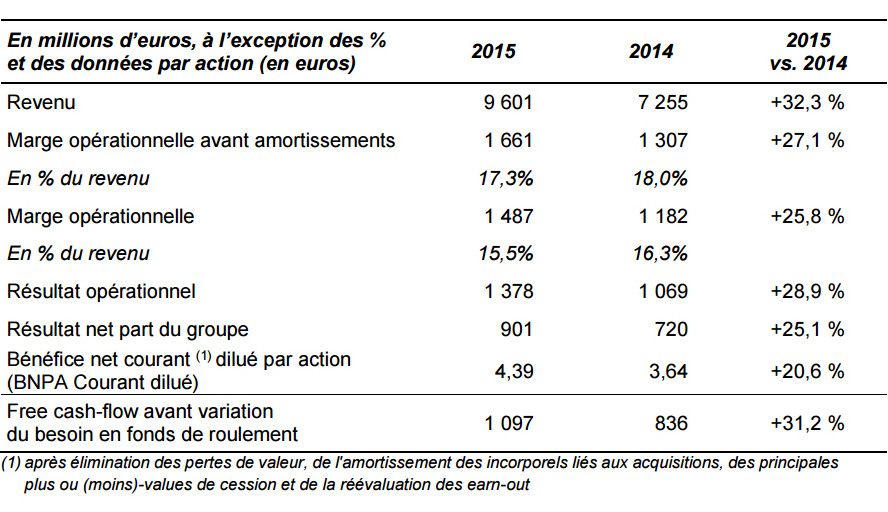

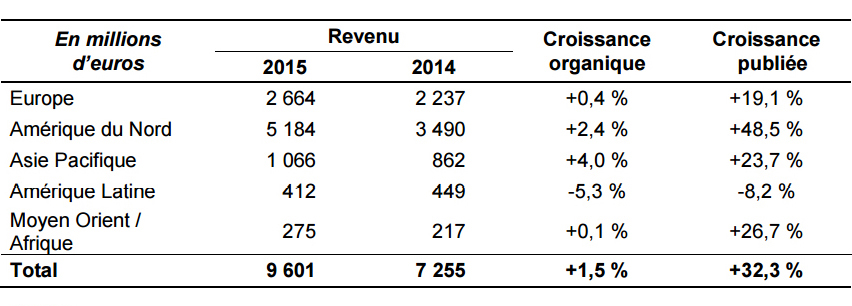

Publicis Groupe’s consolidated revenue for 2015 rose to 9,601 million euro after 7,255 million euro in 2014, i.e. an increase of 32.3%.

More than 60% of the Groupe’s revenue was exposed to the dollar and sterling, and exchange rates had an 823 million euro positive impact on revenue, i.e. 11.3% of 2014 revenue. Acquisitions (net of disposals) contributed 1,399 million euro, i.e. 19.3% of 2014 revenue. At constant exchange rates, growth was 18.9% with organic growth at +1.5%, largely due to the contribution of digital activities (+5.4%).

Europe posted growth of 19.1%. Excluding the impact of acquisitions and exchange rates, organic growth stands at +0.4%. In Europe as a whole, digital registered strong growth at 7.5%. Revenue grew by 1.7% and 5% in France and Germany respectively. The southern European countries returned to positive growth (+1.1%), particularly the Iberian Peninsula (+2.4%) while Italy is close to flat growth (-0.4%). The situation was still difficult in Russia (-6.1%) and in the UK (-4.3%) with the change of management at Publicis Worldwide UK and the reorganization of Razorfish.

North America grew by 48.5%, mostly due to Sapient acquisition and the impact of exchange rates, and organic growth was 2.4%. This improvement stems mainly from the media business and Publicis Worldwide, with digital only growing by 2.3% due to project cancellations in the second half of the year.

Asia Pacific recorded a 23.7% revenue increase and +4.0% organic growth, notably due to good performance in India (+11.0%) and accelerated growth in China in the second half-year (+3.4%) after a first half-year 2015 with growth of 0.1%.

Latin America fell 8.2% (organic growth of -5.3%), due to negative growth in Brazil and Mexico (respectively -7.5% and -13.1%) where the economic situation remains tense.

The Middle East & Africa saw its revenue grow by 26.7% with organic growth of 0.1%.

3.1 – Income Statement

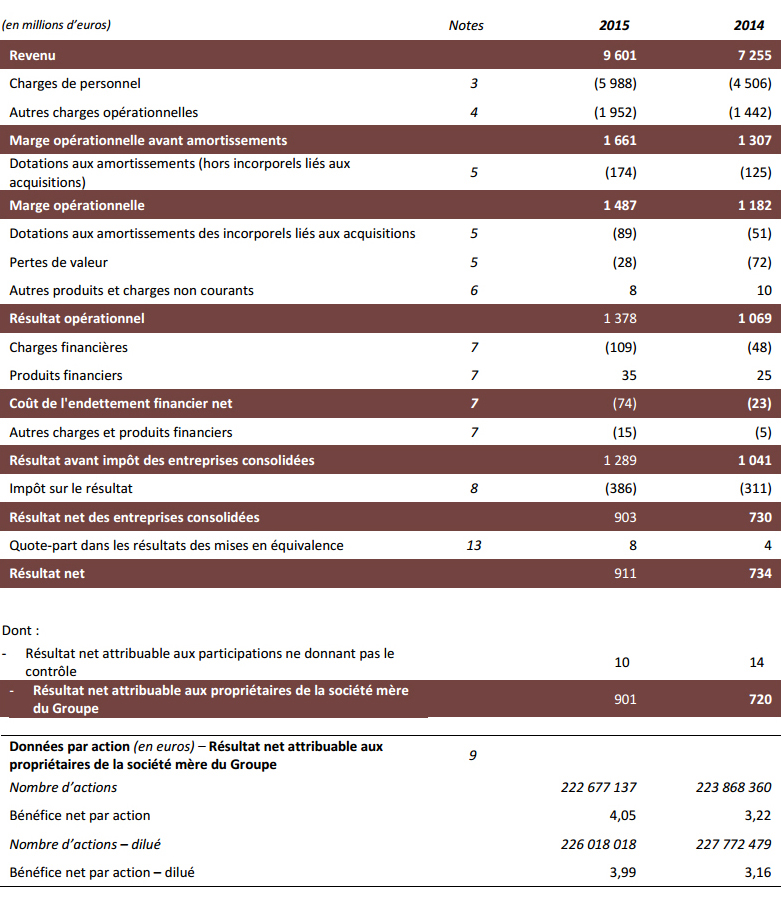

The Operating margin before depreciation and amortization rose to 1,661 million euro in 2015, up 27.1% from 1,307 million in 2014. The percentage operating margin was 17.3% (versus 18.0% in 2014).

Depreciation and amortization totaled 174 million euro in 2015, after 125 million in 2014.

The Operating margin rose 25.8% to 1,487 million euro, up from 1,182 million in 2014.

Operating margin rate was 15.5% in 2015, down 80 basis points on 2014. The operating margin (expressed as a percentage of revenue) benefited from the strengthening of other currencies against the euro, creating a 20-basis point positive impact. At constant exchange rates, the percentage operating margin was down 100 basis points on 2014 due to the dilutive effect of consolidating Sapient and the increase in restructuring costs.

The percentage operating margins by region were 11.1% in Europe, 18.0% in North America, 15.3% in Asia Pacific, 10.7% in Latin America and 18.2% in the Middle East and Africa.

Amortization of intangibles arising from acquisitions totaled 89 million euro in 2015, compared with 51 million in 2014, an increase that stemmed mainly from intangibles arising from the acquisition of Sapient. An impairment charge of 28 million euro was booked for the period (down from 72 million in 2014), mainly concerning Rosetta and Neogama. Other non-recurring income and expenses amounted to a positive 8 million euro, mainly attributable to capital gains and losses on asset sales, after 10 million euro in 2014.

Operating income totaled 1,378 million euro in 2015, i.e. a 28.9% increase on 1,069 million recorded in 2014.

Financial income was an expense of 89 million euro in 2015, compared with an expense of 28 million euro in 2014. The reason the cost of net debt has risen so sharply since the previous period (74 million euro in 2015 versus 23 million euro in 2014) was the cost of funding the Sapient acquisition. Other financial income and expenses deteriorated by 10 million euro, largely due to the revaluation of earn-out payments.

Income tax amounted to 386 million euro in 2015, i.e. an effective tax rate of 29.9%, up from 311 million euro in 2014 when the effective tax rate was 28.0%.

The Associates’ share of profit was 8 million euro compared with 4 million in 2014. Minority interests totaled 10 million euro in 2015, after 14 million euro in 2014.

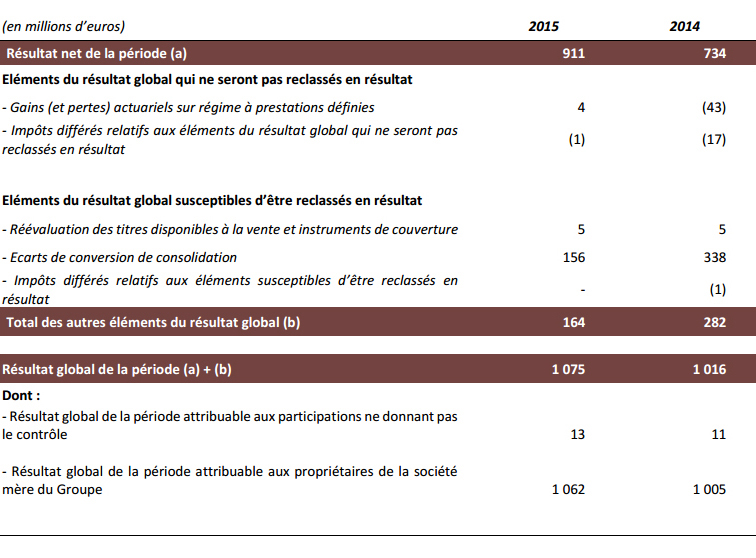

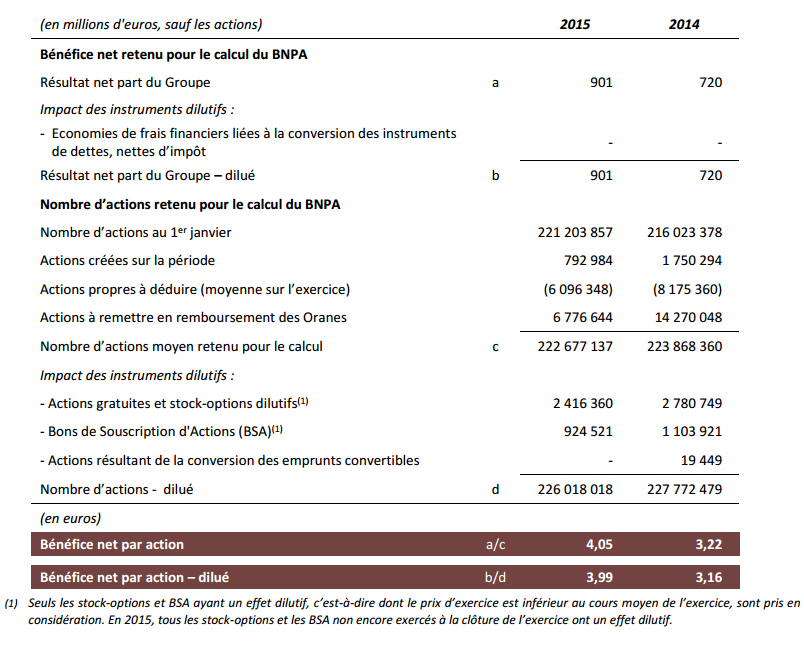

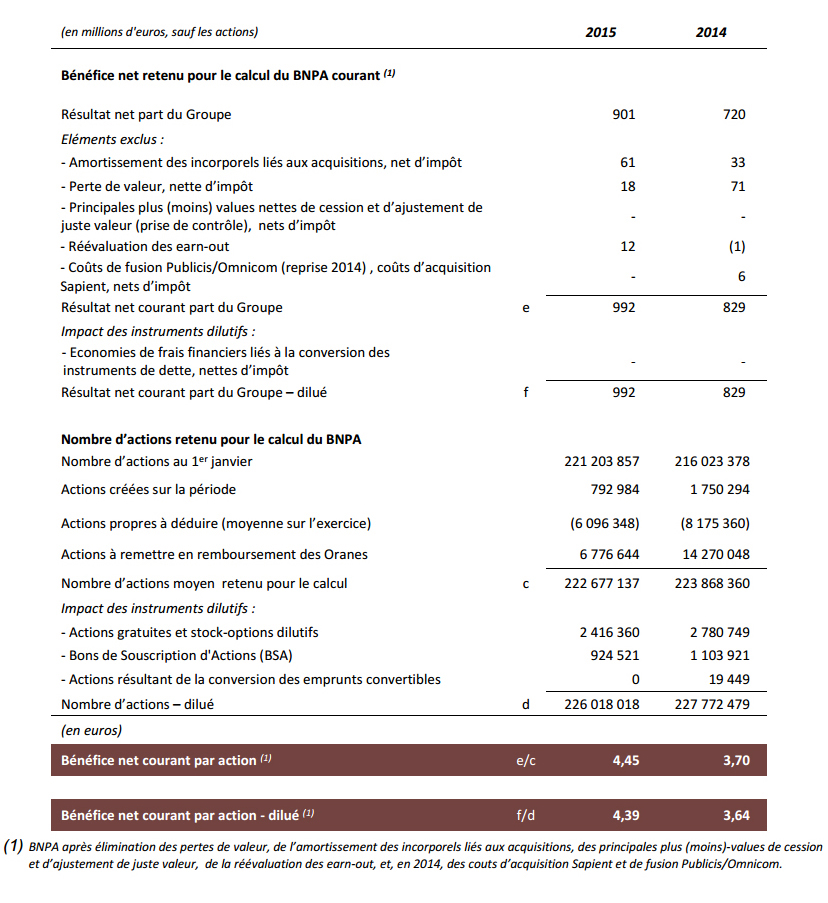

The Groupe net income reached 901 million euro in respect of the 2015 financial period, up 25.1% from 720 million euro in 2014.

After elimination of impairments, amortization of intangibles arising from acquisitions, the main capital gains (or losses) on the disposal of assets and the revaluation of earn-out payments, the Headline Groupe net income was up 19.7% to 992 million euro in 2015.

Headline EPS (diluted) rose 20.6% to 4.39 euro.

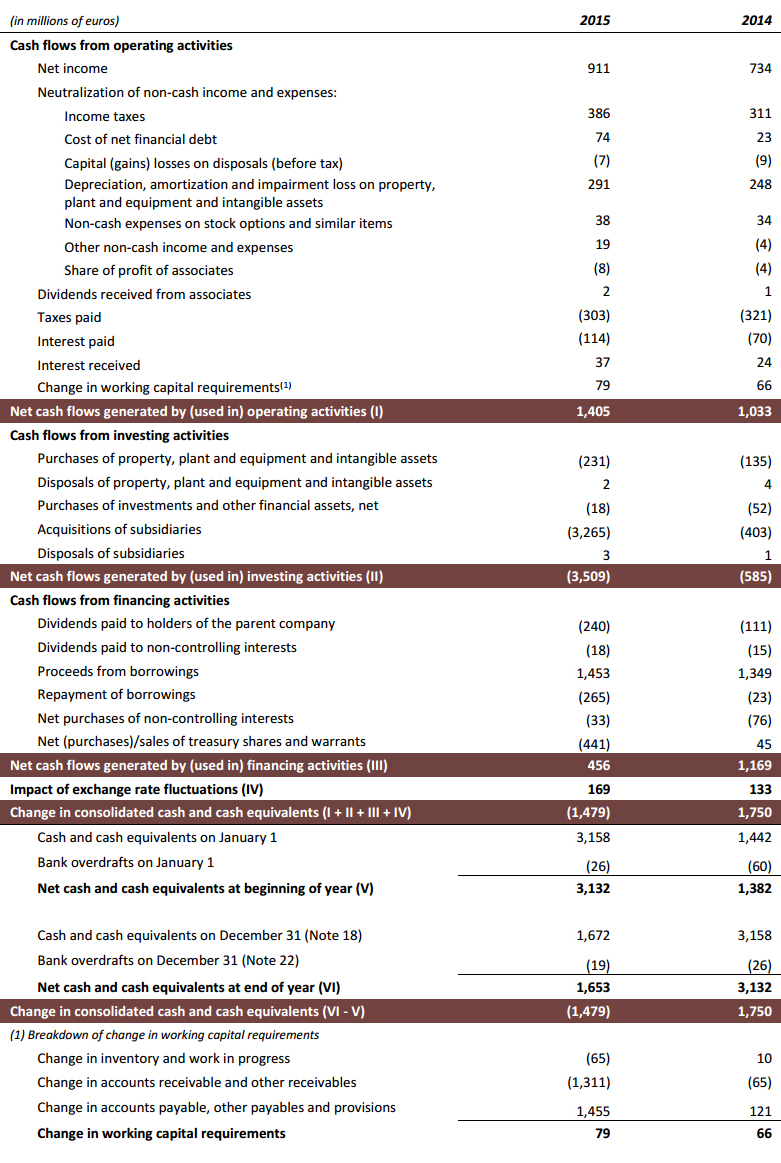

3.2 - Free cash flow

Before changes in working capital requirements, the Groupe’s free cash flow for the period was 1,097 million euro in 2015, compared with 836 million euro in 2014.

3.3 – Net debt Net debt

stood at 1,872 million euro at December 31, 2015, after a cash-positive 985 million euro at year-end 2014. The swing in the net financial situation was mainly due to the acquisition cost of Sapient. The Groupe’s average net debt in 2015 was 2,429 million euro, after an average cash-positive position of 93 million euro in 2014.

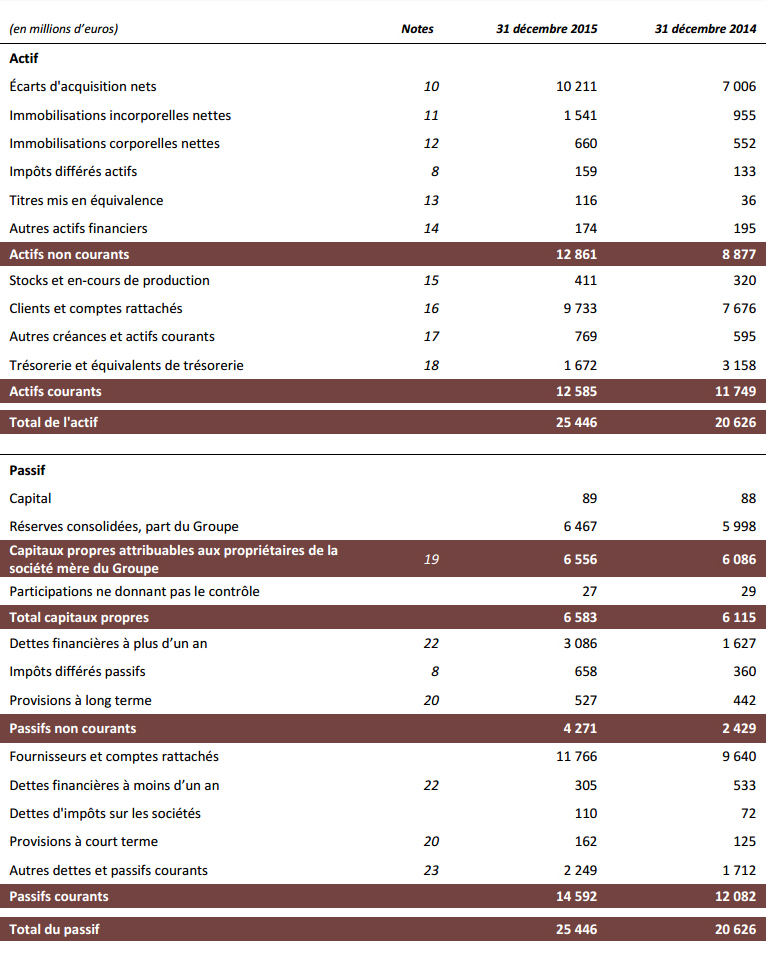

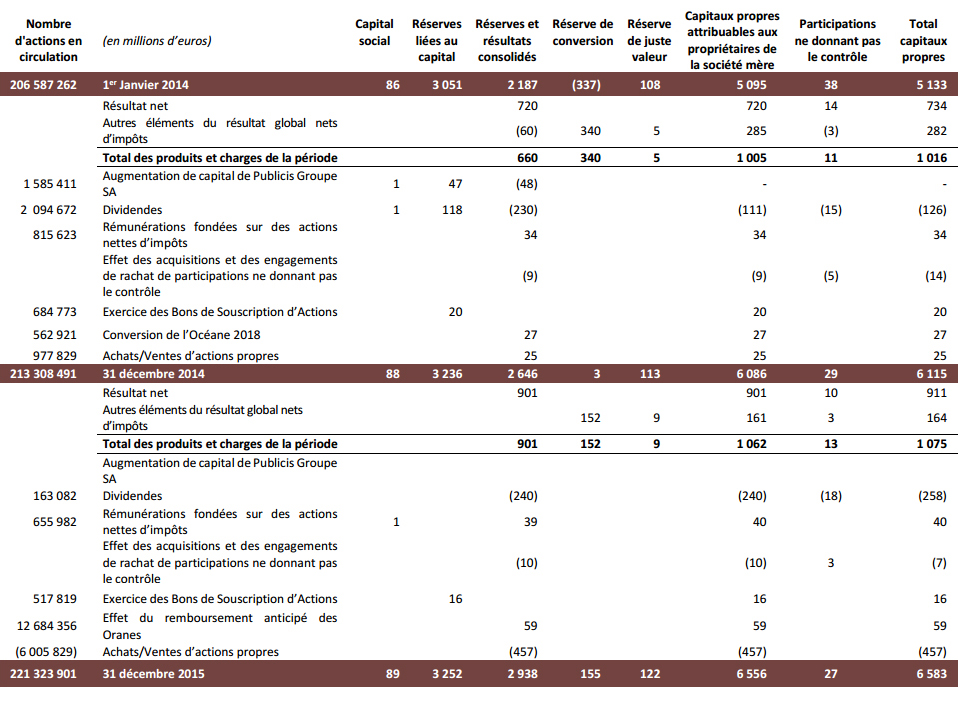

3.4 – Shareholders’ equity

The Groupe’s share of consolidated shareholders’ equity rose from 6,086 million euro at December 31, 2014 to 6,556 million euro at December 31, 2015. This increase was due to income for the period, partly offset by the buyback of Publicis shares from the Badinter family under an agreement with an Investment Services Provider over the period from March 30 to June 9, 2015 (467 million euro in total) and the dividend payout of 240 million euro.

Publicis Groupe’s transformation necessarily goes hand in hand with changes in its CSR strategy. This migration lends itself to greater inclusion and appropriation of the challenges of sustainable development in the daily lives of the Groupe and its agencies. 2015 was the start of a new cycle leading towards integrated reporting.

This year, the Groupe’s efforts focused on the following aspects. Firstly, continued dialogue with the stakeholders to improve how we measure up to their expectations with regard to sustainable value creation, which also enabled us to refine our analysis of the materiality of the Groupe’s CSR challenges. This materiality is articulated around three main groups of stakeholders (employees, clients and society, i.e. consumers) with major emphasis in three main areas (increased training and diversity while facilitating career paths, greater efforts in the field of responsible marketing and communications, and a clarification of data protection issues). Secondly, the Groupe has become more actively involved in a CSR assessment alongside EcoVadis. This supplier assessment program will be ramped up over a period of three years. Finally, at Groupe level, the agencies are working more closely with clients and partners to promote responsible communications and a greater awareness of the social and environmental impacts of our campaigns.

During this year of transition, the Groupe remained focused on human challenges, notably with a view to supporting staff in agencies where the environment is undergoing constant change (technological, organizational, etc.). Continuous training, of which the Groupe provided over one million hours in 2015, is essential in all our activities, as is a more inclusive organization with the wide variety of profiles needed by the Groupe. Furthermore, in-house cooperation methods are becoming increasingly flexible.

In 2015, Publicis Groupe entrusted SGS with an auditing scope corresponding to 98% of the Groupe in terms of staff (Sapient included). This mission included the on-site auditing of 53 entities corresponding to 35% of total headcount (versus 32% in 2014).

Publicis Groupe - which signed up to the United Nations’ Global Compact back in 2003 and to the UN’s Caring for Climate initiative in 2007 – worked in association with a number of corporate coalitions on the occasion of COP21 in Paris as part of the general mobilization in favor of the reduction of greenhouse gases.

5.1 – Reorganization

On December 3, 2015, the Groupe announced its plan to implement the most integrated organization in the sector, calling time on the traditional silo-type structure of communications groups, for the benefit of its clients and its employees alike.

This reorganization into 4 Solutions hubs is in line with the continued implementation of the Publicis.Sapient platform. This platform is unique in the communications sector, bringing together the Groupe’s agencies (Razorfish, DigitasLBi, SapientNitro and Sapient Consulting) with a view to providing clients with a full service offering across the digital communications value chain from consulting to retailing, including creation, data and production platforms.

The purpose of the reorganization is to structure the Groupe in such a way that its clients are at the very heart of its organization. In the Top 20 countries, the Top 50 clients will each be accompanied by a Chief Client Officer, and these CCOs will report to a Chief Revenue Officer. In this way, the Groupe can offer an entire array of solutions to its clients: creative solutions through Publicis Communications, media solutions through Publicis Media, digital solutions from Publicis.Sapient, and healthcare solutions provided by Publicis Health. For all other countries, a single structure called Publicis ONE will combine all of these solutions (creative, media, digital, healthcare) in each country.

The new organization will be rolled out in the first few months of 2016.

5.2 – “Media Palooza”

A very large number of media accounts came up for review in 2015. According to RECMA, there were tenders for over 20 billion dollars worth of billings in 2015. Publicis Groupe was one of the most exposed of the major communications groups. The Groupe largely consolidated its position with clients (Coty, Citi) and recorded notable gains including prestigious accounts such as Taco Bell, VF, Visa and Etihad. Some losses to be noted include the US media accounts of Procter & Gamble and Coca Cola.

5.3 - Blue 449 launch

ZenithOptimedia has launched a new international media network in order to boost growth while developing hitherto unexplored communication methods. This new network, named Blue 449, is headquartered in London, in the offices of the Walker Media agency which has been rebranded as bridgehead for ZenithOptimedia’s new global network.

Blue 449 has offices in 17 cities and works alongside other ZenithOptimedia brands such as Zenith, Optimedia, Performics and Newcast. The new network also acts as a portal providing open-source access to a vast array of businesses within the Groupe including VivaKi.

The Blue 449 launch follows the acquisition of Walker Media by Groupe Publicis in 2014.

Blue 449 is headed by Sébastien Danet (Global Chairman) and James Shoreland (Global CEO). Sébastien Danet is also Global Managing Partner at ZenithOptimedia and Chairman of VivaKi France. James Shoreland was Executive VP in charge of Corporate Development at ZenithOptimedia USA, and has been promoted to become the first CEO of Blue449.

5.4 - Acquisitions

5.5 - Finance

2016 should unravel in a low-growth economic environment with low inflation, characterized by macroeconomic uncertainty and a continued downswing of commodity prices, but also by clients focusing on the very short term (cost reduction plans). Despite this context, Publicis Groupe expects all its financial indicators to increase in 2016: i.e. revenue, operating margin, adjusted EPS, and dividend payout.

The achievements to date in digital and the corporate shift towards a transformation of business models confirm the merits of the Groupe’s long-term strategic orientations and endow it with a real competitive edge. From the operational point of view, Publicis Groupe is currently implementing the most integrated organization in the sector so as to structure the Groupe with its clients at the very heart of its organization to provide them with the complete array of solutions. That structuration should foster the Groupe’s growth through integrated opportunities and new possibilities with consulting and technology, as well as enhance its profitability by simplifying the organization.

This reorganization and the Groupe’s very broad exposure to digital activities (52% of revenue in 2015) should bolster its future growth and continue to improve margins.

Certain information contained in this document, other than historical information, may constitute forward-looking statements or unaudited financial forecasts. These forward-looking statements and forecasts are subject to risks and uncertainties that could cause actual results to differ materially from those projected. They are presented as at the date of this document and, other than as required by applicable law, Publicis Goupe does not assume any obligation to update them to reflect new information or events or for any other reason. Publics Groupe urges you carefully to consider the risk factors that may affect its business, as set out in the 2014 Registration Document filed with the French Autorité des Marchés Financiers (AMF) and which is available on the website of Publics Groupe (http://www.publicisgroupe.com), including an unfavourable economic climate, an extremely competitive market sector, the possibility that our clients could seek to terminate their contracts with us at short notice, the fact that a substantial part of the Group’s revenue is derived from certain key clients, conflicts of interest between advertisers active in the same sector, the Group’s dependence on its directors and employees, laws and regulations which apply to the Group’s business, legal action brought against the Group based on allegations that certain of the Group’s commercials are deceptive or misleading or that the products of certain clients are defective, the strategy of growing through acquisitions, the depreciation of goodwill and assets listed on the Group’s balance sheet, the Group’s presence in emerging markets, the difficulty of ensuring internal controls, exposure to liquidity risk, a drop in the Group’s credit rating and exposure to the risks of financial markets.

Publicis Worldwide

Arla (Belgium), Mobistar (Belgium), Fédération des Médecins Omnipraticiens du Québec (Canada), BASF (Brazil), Henkel (Brazil), Metro_ Santiago (Chile), Sodimac (Chile), Universidad de Piura (Peru), Tencent (China), Heinz ABC (Indonesia), Tourism NT (Australia), Civil Engineering Institute (Macedonia), Roche Macedonia (Macedonia), Heineken (Mexico), Dos Equis (Mexico), Barcel (Mexico), UBS (United Kingdom), SCA (United Kingdom), Jungheinrich AG (Germany), Telekom Deutschland GmbH (Germany), Commerzbank AG (Germany), Bridgestone (Brazil), Habib's (Brazil); Nestlé (Brazil), P&G (Greater China), EverGrande (Greater China), Qihoo360 (India), Mobile Wallet (India), Michelin Tyres (India), Tabcorp (Australia), P&G (Australia), Commonwealth Games (Australia), Samsung (South Africa), Sears, Shop Your Way (USA), Red Lobster (USA), Hofer (Slovenija), KD Skladi (Slovenija), Nissan (Bulgaria), Uber (France), SNCF (France), Citi (Global), Heineken (Global), Emirates (Croatia), Bimbo (Mexico), Astrazeneca (Mexico), Snow beer (Greater China), Citigroup (Mexico), Cortefield (Croatia), Hewlett Packard (Croatia), Novartis (Mexico), Porsche (Mexico), Pepsico (Mexico), Wyeth (Greater China), European Commission (Macedonia), Tempo (Greater China), Maspex (Croatia), 3M (Mexico), Heineken (Mexico), Notarc (Panama), L'oreal (Croatia), Capitalbio (Greater China), Chevrolet (Greater China), Huawei (Greater China), Ferrero (Croatia), Audi (Mexico), Nestlé (Mexico), Grupo Modelo (Mexico), Lily (Greater China), El Comercio (Peru), Molson Coors (Bulgaria), Garnier (Mexico), Strongbow (Croatia), Tsunami (Mexico), Boehringer (Mexico), Zhongan (Greater China), Sanofi (Mexico), Orangina-Schweppes (France), Simobil (Slovenia), Kerry Property (Greater China), Mutualités Chrétiennes (Belgium), Backus (Peru), Bulla (Australia), Telefonica Vivo (Brazil)

Saatchi & Saatchi

HomeAway (United Kingdom), Benecol - Pan European (Fallon London/United Kingdom), Praktiker – digital (Poland), Drinkworks/Monteith's Cider (Australia), Bank SA (Australia), Bank of Melbourne (Australia), Berlitz (Japon), Acer (Singapore), ADT (South Africa), Cadillac (United Arab Emirates / Middle East & North Africa), Toyota Corolla (Australia), Geely (China), Saunier Duval Brand Group (Germany), Siemens (India), Tonno Nostromo (Italy), FWD Group (Singapore/Thailand), Bathstore (United Kingdom), Bauli (Italy), Eurobet (Italy), Hamdard Laboratories (India), Huawei – digital AOR (Mexico), PLDT/Sun Cellular (Philippines), The Big Issue (United Kingdom), Visa 2016 Olympics sponsorship (United Kingdom /Global), Wuling (Indonesia), General Motors – Event Management Agency for Chevrolet, Opel & Isuzu (South Africa)

Leo Burnett

Fererro Chocolates (Italy), Allergan Medical Aesthetics (Singapore), OSN Cable & Network Provider (United Arab Emirates), Marshall’s (USA), Big W (Australia), Brooks Running (USA), Bridgestone Olympics Activation (USA), Avios (United Kingdom), Fortis Healthcare (India), GEMS World Academy (Singapore), Samsung Digital AOR (Vietnam), Tigerair (Singapore), Masafi (UAE), Lurie Children’s Hospital (USA), T-Mobile (Poland), iSelect (Australia), Canon media (Australia), First Gulf Bank (UAE), China Mobile (China), HDFC Bank (India), Sterlite Technologies (India)

BBH/NEOGAMA

Tesco (United Kingdom), Coverfox (India), Samsung (UK), King (China), Magnum watches (Brazil), Viva Channel (Brazil), Vale (Brazil), Infocus (India), Heinz (United Kingdom), JBL (USA), Nest (USA), Pillpack (USA), Netflix (USA), Seamless (USA), Prostate Cancer (United Kingdom)

DigitasLBi

BP East of Rockies (USA), Sony PlayStation (USA), Pandora (USA), CÜR Music (USA)

MSLGROUP

Alcon (USA), 24 Hour Fitness (USA), Rover.com (USA), AIG (France), Conforama (France), Elior (France), Michelin (France), Cathay Pacific (Netherlands), Ranstad Holding (Netherlands), Nivea (Poland), ThyssenKrupp AG (Poland), ING (Poland), Mahanagar Gas Limited (India), Alstom (India), Belkin International (Singapore, Hong Kong, China), Alibaba.com (China), Orient Europharma (Taiwan), Instagram (Italy), Reckitt Benckiser (Italy), Amazon (Poland), Federation of German Industries (Germany), Rotterdam World Gateway Terminal (Netherlands), Fiat (Brazil), Marriott (Hungary), Pratt and Whitney (Singapore), Credit Agricole (France), Sanofi Pasteur (France), Orange (France), American Public Health Association (USA), BP (Netherlands), Uber (Germany), Lockheed Martin (Poland), Amgen (Italy), Lidl (France), Maison du Monde (France), Engie (France), Alibaba (China), Dongfeng Nissan (China), Cath Kidston (China), Hyundai (China), Adidas (Taiwan), AXA (Brazil), lifeIMAGE (USA), RaceTrac (USA), Volusion (USA), Stichting Nederlands Debat Instituut (Netherlands), Randstad Holding (Netherlands), New Venture (Netherlands), Holmatro (Netherlands), ARN Car Recycling (Netherlands)

Starcom MediaVest Group

Alcro Beckers (Sweden), Answear.pl (Poland), AUDIO (Turkey), Bankimia (Spain), Bla bla car (India), BMW (China), Canon (Australia), Cartoon Network (Turkey), CSOB (Czech), Dabur India Ltd (India), Discovery Channel (Poland), Dogtas / Kelebek (Turkey), du Telecom - Performance Media (UAE), Dubai Culture - Social (UAE), Dublin Airport Authority (Ireland), Dutch Government - social security counsel (Netherlands), Empik (Poland), Etihad Airway Partners (Global), Government Stichting pensioenregister (Netherlands), Gul Yapi (Turkey), Infocomm Development Authority of Singapore (Singapore), Kalbe (Malaysia), Keurig Green Mountain (USA), Kozmoklinik (Bio Oil) (Turkey), Lexa (Netherlands), Liberty Insurance (Poland), Lidl (UK), Mathijs Maaltijdbox (Netherlands), Morgan Stanley (USA), National Environment Agency of Singapore (Singapore), NBA (National Basketball Association) (USA), New York Life (USA), Nielson FS (UK), Nutella (Ferrero) (Turkey), Oppo India (India), Piatnica (Poland), Pingan (China), Poczta Polska (Post Office) (Poland), PPG Deco (Poland), Qingku - Herbal Tea (China), Royal London (UK), Seguros Constitución (Panama), Singapore Airlines (Malaysia/Thailand), Sun Generation Ltd (Poland), Tacit Development (Poland), TAMEK GIDA (Turkey), Tauron (Poland), Telenor (Sweden), Telenor ASA (Norway), Tempo Scan (Indonesia), TomTom (Global), Turkcell Music (Turkey), TVN (Poland), UNHCR (Italy), Vakko (Turkey), Valspar (USA), VF Corp (USA), Viacom (Poland), Vimpelcom (Russia/Ukraine/CIS), Visa (Global), Walmart (Mexico), White Wave Foods (USA), Wonga (Poland), Yorukoglu (Turkey)

ZenithOptimedia

eis.de (Allemagne), Pixmania (France), Toyota (Slovakia, Czech Republic), Mercedes-Benz (Romania), BRD - Groupe Société Générale (Romania), Bella Food (Romania), AXN Europe Limited (Romania), L'Oréal (Bolivia), Viva (Bolivia), ABInBev (Bolivia), Nestlé (Bolivia), NH Hotels (Colombia), Istanbul Cerrahi Hospital (Turkey), The Euroepan Commission (Armenia), Alkaloid (Armenia), Coty (Global, 13 markets), Harvey Nichols (United Kingdom, Kimberly Clark (USA, digital creative/production), Uniqlo (United Kingdom), Uber (France), Corbis Corporation, IAAF, Pitch International, AMS (Global and regional research and analysis for global and regional sports federations, bodies and marketing agencies), Molson Coors (Romania), College Football Hall of Fame (USA, digital creative/production), GNV (Italy), 4a-event (Belarus), Singapore Airlines (Global), Czech Tourism (Czech Republic), Truecaller (India), Frank Lloyd (Netherlands), BASF (global), Samsung (South Africa), First Gulf Bank (GCC), JM (Sweden & Norway), Newsphone (Greece), Hyundai (Colombia), House of Travel (New Zealand), Home Shop 18 (India), De Lijn (Belgium), Pandora ME (GCC), LVMH (S.Korea), Daimler (Luxembourg), Watson’s (Turkey), National Arts Council (Singapore)

Publicis Groupe networks and agencies consistently rank among the most awarded in the world. According to the Gunn Report, Publicis Groupe counts 50% of the best film commercials made in our industry over the last 15 years, and Publicis Groupe’s creative networks are cumulatively the most awarded in the world (Leo Burnett, Saatchi & Saatchi, Publicis Worldwide, BBH, Fallon).

Notable awards for each network are listed below:

BBH

BBH London

BBH Singapore

BBH NY

DigitasLBi

Leo Burnett

MSLGROUP

Prodigious

Publicis Worldwide

Publicis Healthcare Communications Group

Razorfish Global

Saatchi & Saatchi

Sapient

Starcom MediaVest Group

ZenithOptimedia

08-01-2015 - Publicis Groupe Extends Tender Offer to Acquire Sapient

15-01-2015 - Publicis Groupe Names Anthony Gazagne President of PublicisLive

23-01-2015 - Publicis Groupe Extends Tender Offer to Acquire Sapient

27-01-2015 - Publicis Groupe Acquires French Digital Marketing Agency Monkees to be aligned with Publicis Activ

29-01-2015 - Jean-Michel Bonamy Joins Publicis Groupe as Vice-President Investor Relations & Strategic Financial Planning

04-02-2015 - Publicis Groupe and Sapient Receive all Regulatory Approvals for Proposed Acquisition

06-02-2015 - Publicis Groupe Completes Acquisition of Sapient

12-02-2015 - 2014 annual results

16-02-2015 - Publicis Groupe and Relaxnews Announce the Start of Exclusive Negotiations in View of the Acquisition of Relaxnews, press agency specialized in lifestyle content creation, at a valuation of €9.58 per share

26-02-2015 - Publicis Groupe Acquires Integrated Strategic Communications Agency, Epic Communications. Agency to Join the MSLGROUP Network in South Africa

12-03-2015 - Publicis Groupe Strengthens Publicis.Sapient's Leadership in Omni-Channel and Connected Commerce with Acquisition of Expicient Inc

17-03-2015 - Share Buyback

25-03-2015 - Update On Publicis Groupe Always On Platform

30-03-2015 - Share Buyback Contract

21-04-2015 - Q1 2015 revenue

13-05-2015 - Share Buyback Contract

28-05-2015 - 2015 Combined Shareholders' Meeting

01-06-2015 - Acquisition of Relaxnews at a Price of 9.58 Euro per Share

23-06-2015 - Notice of Early redemption of ORANE

29-06-2015 - Arthur Sadoun, President of Publicis Worldwide, will take on the direct supervision of MSLGROUP. Olivier Fleurot will join the Groupe's holding as Senior Vice President

22-07-2015 - First-half 2015 results

23-07-2015 - Early Redemption of ORANE

19-08-2015 - Chris Foster Appointed SVP Global Clients, Publicis Groupe

10-09-2015 - Publicis Groupe Makes Major Leap in South Africa with Acquisition of The Creative Counsel Group

19-10-2015 - JCDecaux and Publicis Groupe announce that they have entered into exclusive negotiations in the context of increasing JCDecaux’s participation in the capital of Metrobus from 33% to 100%.

22-10-2015 - Q3 2015 revenue

27-10-2015 - Orange and Publicis Groupe Announce the Creation of IrisNext One of the Biggest MultiCorporate Venture Capital Funds in Europe

24-11-2015 - Acquisition of leading Israeli Creative Agency, Glickman Shamir Samsonov in Tel-Aviv

03-12-2015 - Publicis Groupe Announces Important Nominations and its Transformation Plan

14-12-2015 - Publicis Groupe Named 2015 Adobe Digital Marketing Partner of the Year

EBITDA: operating margin before depreciation

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of revenue

Net income group share: Group net income after elimination of impairment losses, amortization of intangibles from acquisitions, main capital gains and losses on disposal of assets, revaluation of earn-out payments and costs related to merger with Omnicom project and Sapient acquisition.

EPS (Earnings per share) : Net income group share divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted) : Net income group share divided by average number of shares, diluted.

Capex: Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

ROCE (Return On Capital Employed) : Operating Margin after Tax (using Effective Tax Rate) / Average employed capital. Capital employed include Saatchi & Saatchi goodwill which is not recognised in consolidated accounts under IFRS.

Net Debt (or financial net debt) : Sum of long and short financials debt and debt-hedging derivatives linked with, net of treasury and cash equivalents.

Average net debt: Average monthly average net debt.Dividend pay-out : Dividend per share / EPS

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 103,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS