Subscribe

Sign up to receive the Publicis Groupe newsletter

Sections

Date of publication

No results were found for your search

Subscribe

Sign up to receive the Publicis Groupe newsletter

07/06/2018, Paris

Publicis Groupe SA [Euronext Paris: FR0000130577, CAC40] has applied IFRS15 “Revenue” accounting standard since January 1, 2018 and will also apply IFRS16 “Leases” accounting standard in advance, as of January 1, 2018. In so doing, the Groupe will have, as soon as 2018, implemented all major account principle changes expected over the next 3 years of its “Sprint To The Future” strategic plan, and will have numbers on comparable basis for the plan. This will provide a better understanding of a strategic plan that covers 2018, 2019 and 2020, which was presented at the Investor Day on March 20, 2018. Organic growth and operating margin rate improvement objectives communicated at that time remain unchanged.

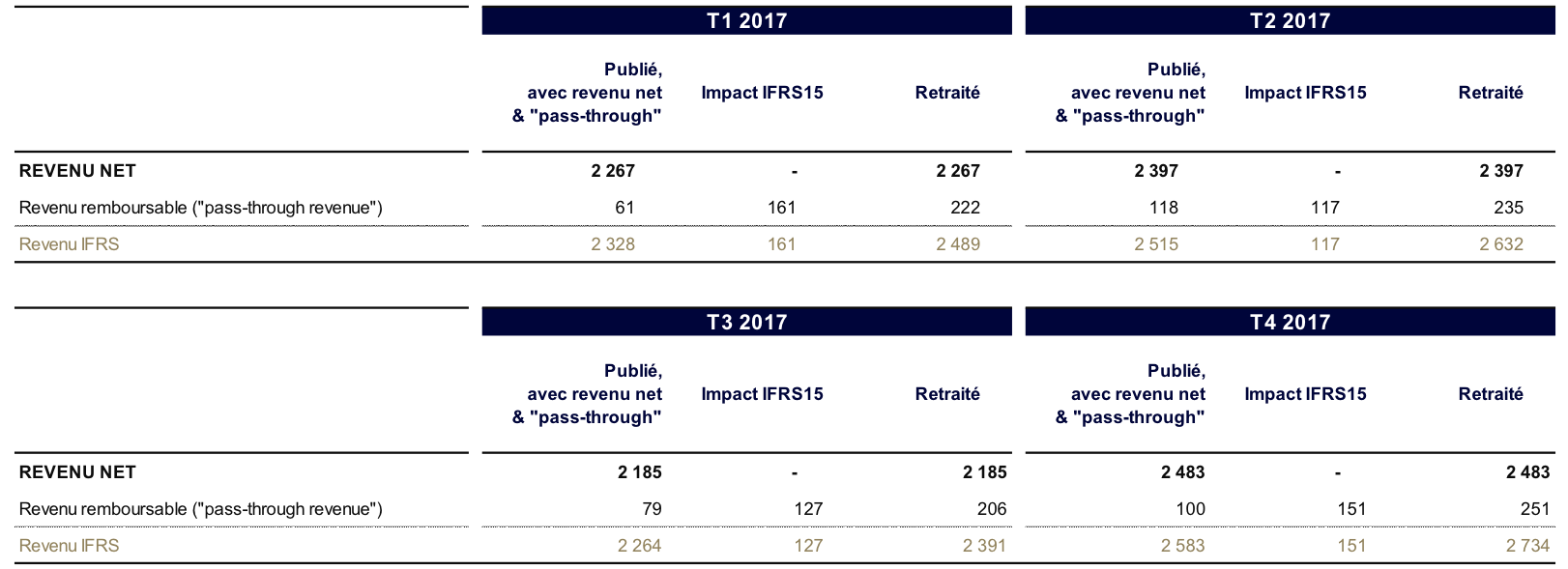

IFRS15 “Revenue”: This accounting standard increases IFRS revenue insofar as certain costs re-billed directly to clients are excluded from revenue. These costs mainly concern production activities as well as various expenses incumbent on clients.

In this context, as the items that can be re-billed to clients do not come within the scope of assessment of operations, Publicis Groupe has decided to use a different indicator, i.e. Net Revenue (See definition in Appendix 5), which is a more relevant indicator to measure the operational performance of the Groupe’s activities. The bridge from IFRS15 revenue to net revenue is provided below.

This press release aims to provide:

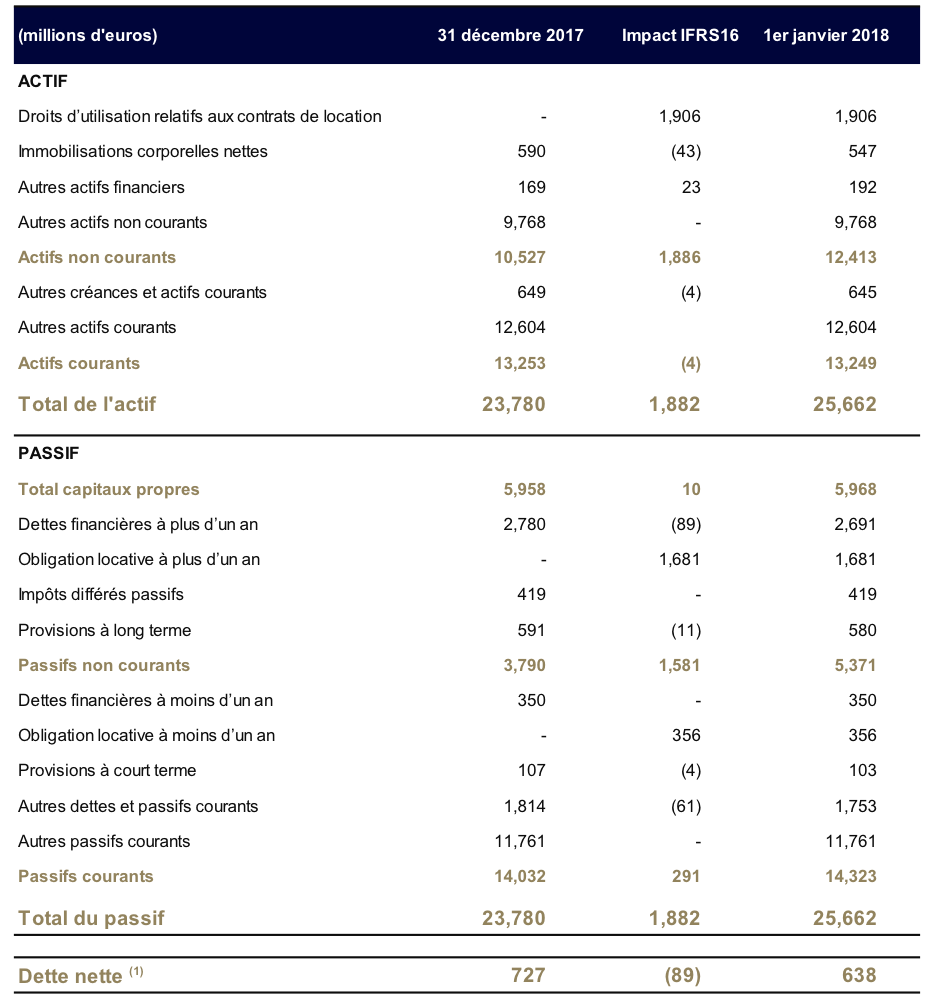

IFRS16 “Leases”: Publicis has also decided to early adopt IFRS16 accounting standard as of January 1, 2018.

This accounting standard considers all lease contracts under a single model by which a lease contract is accounted for as a liability (discounted future payments), and a right of use is accounting for as an asset. The right of use will be amortized over the period of the lease contract (taking into account option periods during which the exercise is reasonably certain).

Contracts committed by Publicis for which this accounting standard applies, are:

Publicis has retained the “prospective method” allowed by the accounting standard by which the cumulative effect of the standard will be accounted for as an adjustment to the opening equity, considering the “right of use” asset equals the amount of the lease commitment, adjusted for rents paid in advance. The opening balance sheet with the application of IFRS16 as of January 1, 2018 is provided in appendix 4. Besides, the 2017 consolidated income statement will not be restated. The Groupe will communicate 2018 half-year and full-year results including IFRS16 and will provide those financial items excluding IFRS16.

The information communicated in this press release are currently reviewed by auditors as part of the half-year review process as of June 30, 2018.

APPENDIX 1 : 2017 revenue with IFRS15 (million euros)

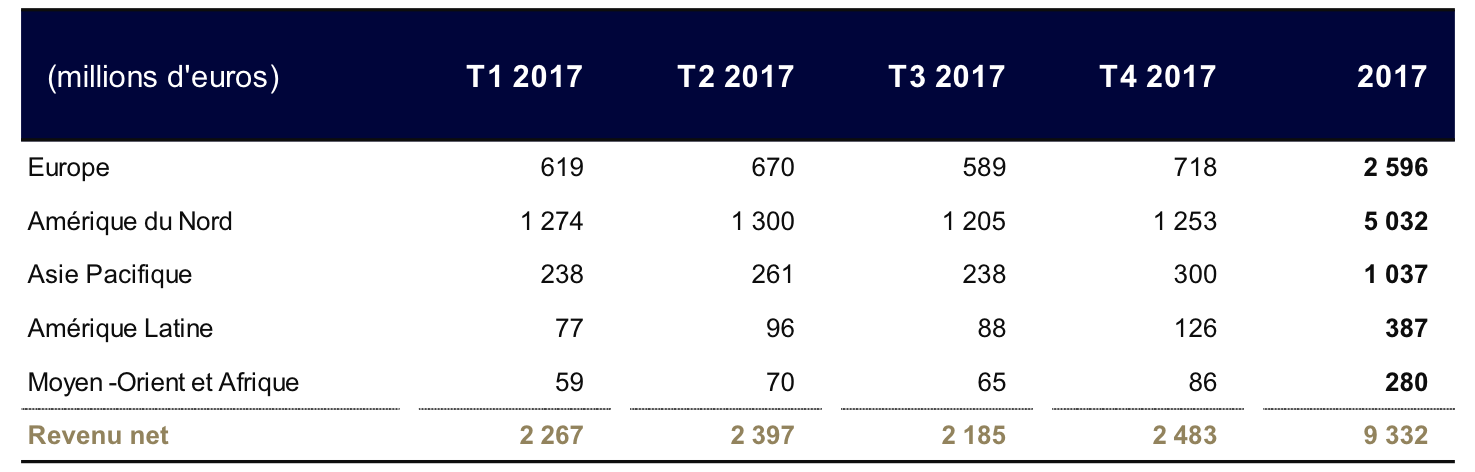

APPENDIX 2: 2017 net revenue by geography

APPENDIX 3: 2017 results with IFRS15 (million euros)

APPENDIX 4: Simplified balance sheet with IFRS16 (unaudited)

Impact of first application of IFRS16 on balance sheet opening are:

1 See definition in Appendix 5

APPENDIX 5: Definitions

Net revenue or Revenue less pass-through costs: Pass-through costs mainly concern production and media activities, as well as various expenses incumbent on clients. These items that can be re-billed to clients do not come within the scope of assessment of operations, net revenue is a more relevant indicator to measure the operational performance of the Groupe’s activities.

Organic growth: Change in net revenue excluding the impact of acquisitions, disposals and currencies.

EBITDA: operating margin before depreciation.

Operating margin: Revenue after personnel costs, other operating expenses (excl. non-current income and expense) and depreciation (excl. amortization of intangibles arising on acquisitions).

Operating margin rate: Operating margin as a percentage of net revenue.

Headline Group Net Income: Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments

EPS (Earnings per share): Group net income divided by average number of shares, not diluted.

EPS, diluted (Earnings per share, diluted): Group net income divided by average number of shares, diluted.

Headline EPS, diluted (Headline Earnings per share, diluted): Group net income after elimination of impairment charges, amortization of intangibles arising from acquisitions, main capital gains (or losses) on disposals, effect of US tax reform and revaluation of earn-out payments, divided by average number of shares, diluted.

Capex : Net acquisitions of tangible and intangible assets, excluding financial investments and other financial assets.

Free Cash Flow before changes in working capital requirements: Net cash flow from operating activities before changes in WCR linked to operating activities.

Net Debt (or financial net debt): Sum of long and short financial debt and associated derivatives, net of treasury and cash equivalents.

Average net debt: Average of monthly net debt at end of month.

Dividend pay-out: Dividend per share / Headline diluted EPS.

Publicis Groupe [Euronext Paris FR0000130577, CAC 40] is a global leader in communication. The Groupe is positioned at every step of the value chain, from consulting to execution, combining marketing transformation and digital business transformation. Publicis Groupe is a privileged partner in its clients’ transformation to enhance personalization at scale. The Groupe relies on ten expertise concentrated within four main activities: Communication, Media, Data and Technology. Through a unified and fluid organization, its clients have a facilitated access to all its expertise in every market. Present in over 100 countries, Publicis Groupe employs around 103,000 professionals.

Jean-Michel Bonamy

Deputy CFO

Amy Hadfield

DIRECTOR OF GLOBAL COMMUNICATIONS